BA3 CIMA Fundamentals of financial accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA BA3 Fundamentals of financial accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A ledger account is opened with a credit balance of $400. During the period the account is credited with $5,800 and debited with $6,500

What balance will open this account in the following period?

Internal controls are used to prevent errors occurring, as well as to detect errors which may have already occurred.

Which one of the following is an example of a 'prevent' control?

Which ONE of the following organizations issues International Accounting Standards (IFRS’s)?

Which of the following is an example of where the materiality convention should be applied?

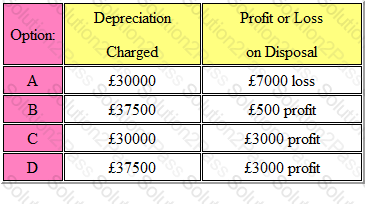

Refer to the Exhibit.

Your organization bought a machine for £50,000 at the beginning of year 1, which had an expected useful life of four years and an expected residual value of £10,000; the machine was depreciated on the straight-line basis.

At the beginning of year 4, the machine was sold for £13,000

The total amount of depreciation charged to the income statement over the life of the machine, and the amount of profit or loss on disposal was:

The answer is:

The issue of a company's shares for more than their normal value results in the creation of a

Which THREE of the following are intrinsic elements of intangible assets?

A contra entry is best described as:

A company is preparing its accounts to 30 November. The latest gas bill received by the company was dated 30 September and included usage charges for the quarter 1 June to 31 August of $5,700 and a service charge of $1,200 for the quarter 1 October to 31 December. It is estimated that the gas bill for the following quarter will be a similar amount.

What will be the amount of the accrual shown in the accounts at 30 November 2006?

Accounting codes have proven to be very useful when recording business transactions.

Which THREE of the following does a coding system help to do?

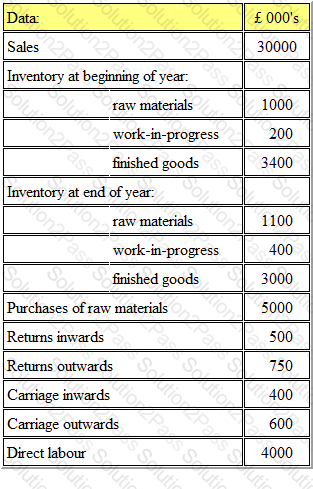

Refer to the Exhibit.

The following information relates to a business at its year end:

The prime cost of goods manufactured during the year is:

Which THREE of the following are characteristics of management accounting?

A non-current asset was purchased for £240000 at the beginning of Year 1, with an expected life of 7 years and a residual value of £50000. It was depreciated by 20% per annum using the reducing balance method.

At the beginning of Year 4 it was sold for £100000. The result of this was:

In accordance with IAS 7 Statements of Cash Flow, which TWO of the following are cash flows presented as investing activities?

Which THREE of the following items would be classified as "capital transactions"?

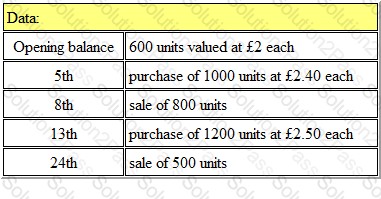

Refer to the Exhibit.

Your organization uses the Weighted Average Cost method of valuing inventory.

During a particular month, the following inventory details were recorded:

The value of the inventory at the end of the month was

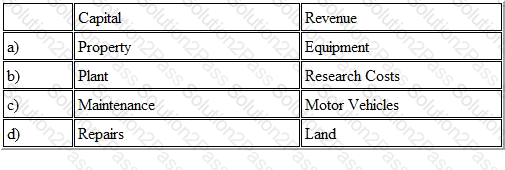

Refer to the Exhibit.

Transactions are often categorized between capital and revenue

Which of the following combinations are correct?

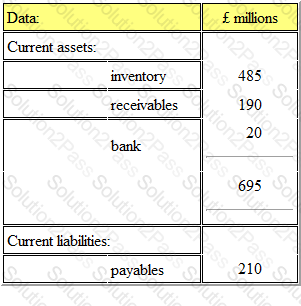

Refer to the exhibit.

A company has the following current assets and liabilities at its most recent year end:

When measured against standard acceptable levels for liquidity, the company can be said to have:

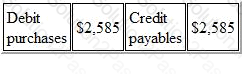

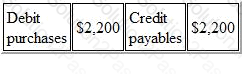

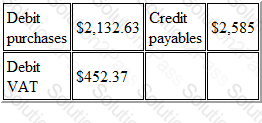

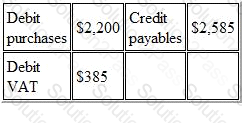

A company which is VAT-registered receives an invoice for goods purchased for resale totaling $2,585 from a supplier that is not VAT-registered. VAT is at the rate of 17.5%.

The correct entry to record the invoice is:

A)

B)

C)

D)

Different users have different needs from financial information. One of which is to assess how effectively management is performing and how much profit will be available to be distributed.

Which of the following users will have this need for information?