BA3 CIMA Fundamentals of financial accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA BA3 Fundamentals of financial accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

FY owns bakery T. Which of the following are examples of FY's liabilities?

Refer to the Exhibit.

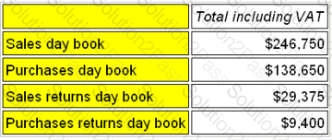

A company that is VAT-registered has the following transaction for the month of March. All purchases were in respect of goods for resale and all items were subject to VAT at 17.5%.

Opening inventory was $16,200 and closing inventory was $18,400.

The gross profit for the period was

On 31 December 20X6 GHI makes a bonus issue of 50,000 shares On this dale the nominal value of the shares is $1 and the market value is $3 GHI has a share premium account with a substantial credit balance. The share capital account is credited correctly in the nominal ledger. Which of the following statements is TRUE?

Which of the following represent liabilities of a business?

Which of the following methods of inventory valuation is not acceptable in the UK for financial reporting purposes?

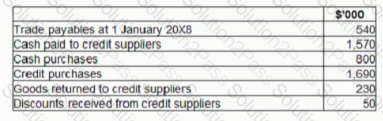

BCD has the following balances for the year ended 31 December 20X8:

What is the trade payables balance of BCD at 31 December 20X8? Give your answer to the nearest $"000.

Refer to the exhibit.

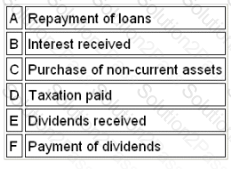

In a statement of cash flows, which three of the following would be found under the section "cash flows from investing activities"?

IAS 2 Inventories does not permit the use of the last in. first out (LIFO) method of valuing inventory In a time of rising prices, which of the following is a reason for this?

The petty cash imprest is restored to £500 at the end of each week. The following amounts are paid out of petty cash during week 23:

(a) Stationery - £70.50 (including VAT at 17.5%)

(b) Travelling costs - £127.50

(c) Office refreshments - £64.50

(d) Sundry payables - £120.00 plus VAT at 17.5%

The amount required to restore the imprest to £500.00 is:

Give your answer to 2 decimal places.

The Finance Director of EFG company has made the following statements regarding the recording of expenditure relating to the entity's property, plant and equipment (PPE) in the nominal ledger.

Which THREE of the following statements are true?

A business has expanded rapidly during the current year. As a result the accounting records have been building up and the management accountant is having problems producing reports for each department head.

Which of the following would be the best solution if introduced?

Which one of the following is an example of where the accrual or matching convention should be applied?

Below are a list of entries from FG's accounts, from the most recent accounting period:

Petty Cash £150 DR

Returns Outwards £310 CR

Purchases £820 DR

Sales £250 CR

FG started the period with a bank balance of £405 DR. The total bank account at the end of period was £1,065 DR

Which of the above items has been omitted from the bank account total?

A company's cashbook has an opening balance of £4,860 debit. The following transactions then took place:

(a) Cash sales - £23,500, including VAT of £3,500

(b) Receipts from customers - £18,600

(c) Payments to payables £12,400, less cash discounts of £240

(d) Bank Charges - £260

What will be the resulting balance in the cash book?

Accounting standards and company law both influence how assets and liabilities ate classified and presented in financial statements

An amount owing at the year end, due for repayment more from one year from the date that the statement of financial position is being prepared, will be

classified under which of the following headings?

An organization’s cash book has an opening balance in the bank column of $4,850 credit.

The following transactions then took place:

(a) Cash sales of $14,500, including VAT of $1,500.

(b) Receipts from customers of debts of $24,000.

(c) Payments to creditors of debts of $18,000, less 5% cash discount.

(d) Dishonored cheques from customers amounting to $2,500.

The resulting balance in the bank column of the cash book should be:

Where a transaction is credited to the correct ledger account but debited to the purchases account instead of the fixed asset account, the error is known as an error of:

At the beginning of the year, an organization’s non-current asset register showed a total net book value for fixed assets of £86,000. The nominal ledger showed non-current assets at cost of £120,000 and provision for depreciation of £39,000.

The disposal of a non-current asset for £10,000, at a profit of £2,000, had not been accounted for in the non-current asset register.

After correcting for this, the net book value shown in the ledger accounts would be

Company H receives a 10% discount on its order from supplier GD. Which ONE of the following does the discounted amount count as for Company H?

Which of the following financial documents contains the manufacturing account?