BA3 CIMA Fundamentals of financial accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA BA3 Fundamentals of financial accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

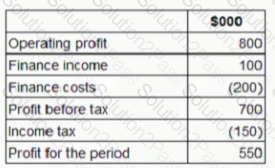

GG has the following statement of profit or loss extract for the year ended 31 December 20X3

What is the interest cover for GG for the year ended 31 December 20X3?

2.8 times

4.0 times.

4.5 times

3.5 times

Internal controls can be split between detect controls and prevent controls.

Which THREE of the following are prevent controls?

Which of the following is an example of a transaction that affects profit, but does not affect cash?

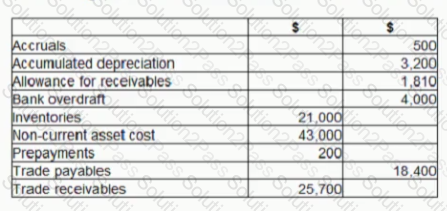

The following is an extract of the trial balance of XYZ as at 31 December 20X7

What is the total value of assets to be included in the statement of financial position? Give your answer to the nearest $

Refer to the Exhibit.

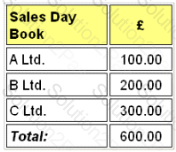

The sales day book for the last month, appeared as follows:

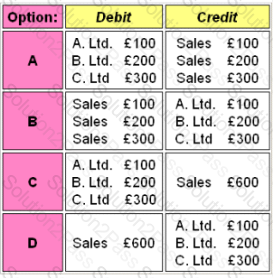

The entries which should be made in the ledger accounts are:

The answer is:

The Accounting Standards Board is responsible for:

Which one of the following would not be classified as an efficiency ratio?

In internal auditing, detection of fraud is an important objective. The auditors will best be able to detect frauds if they are knowledgeable in the most common methods of fraud.

Which THREE of the following are common methods of fraud?

The IASB's Framework for the Preparation and Presentation of Financial Statements identifies four possible measurement bases for use in financial statements

Which of the following are those bases?

Refer to the Exhibit.

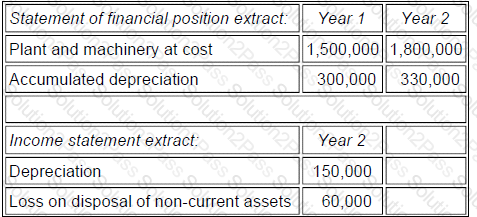

The following information is available relating to the non-current assets of Company X:

Non-current assets that had originally cost $225,000 and had a carrying value of $105,000 were sold during the year.

The figure for purchases of non-current assets to be shown in the statement of cash flows will be, to the nearest $1,000:

An increase in work-in-progress will:

Which ONE of the following deals with problems that arise with existing accounting standards?

Refer to the exhibit.

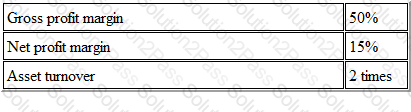

The following ratios have been calculated for A Limited:

The return on capital employed for A Limited is therefore

Which of the following represent items of income for a business?

Refer to the Exhibit.

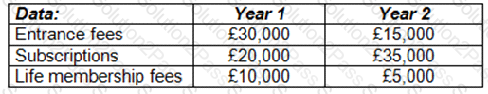

A club receives the following fees in its first two years of operations:

Entrance fees are to be recognized over a period of 5 years while life membership fees are to be credited over a period of 10 years.

The total amount of fees which will be recognized in the income and expenditure account for each of the two years is:

A business will maintain a non-current asset register to keep a record of all non-current assets held.

Which THREE of the following are examples of information contained within the register?

What is the balance of the trading account?

Refer to the Exhibit.

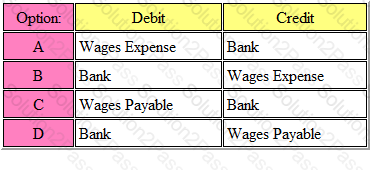

The correct ledger entry for payment of net wages to employees is:

The answer is:

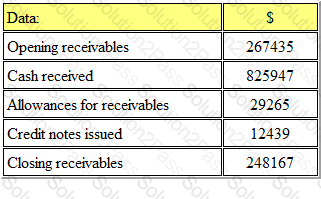

Refer to the Exhibit.

From the following information, calculate the value of sales for the period:

Value of sales is

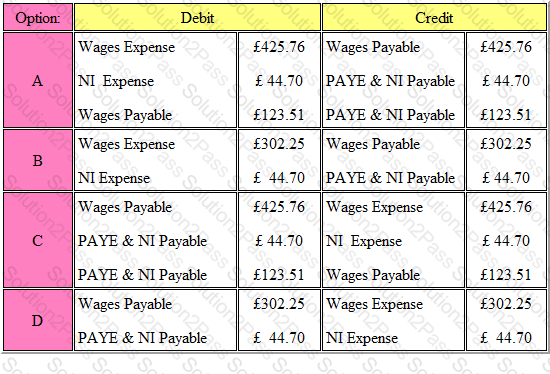

Refer to the Exhibit.

John, an employee of Kelt Ltd, earns gross wages for a week of £425.76.

Income tax is deducted at a rate of 25% on all earnings in excess of £85.00 per week and he is also liable to pay National Insurance contributions of 9% of his total earnings. Employers national insurance contributions are at a rate of 10.5%.

What are the correct ledger entries in the accounts of Kelt Ltd?

The answer is: