BA3 CIMA Fundamentals of financial accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA BA3 Fundamentals of financial accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

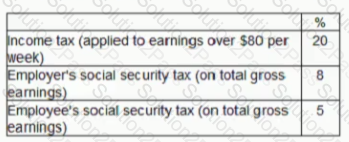

EFG pays employees $10 per hour The following rates of tax and social security are applicable.

An employee works 38 hours in a week.

What is the amount employee receives for one week’s work? Given you answer to the nearest $.

Mr UY has just had property P re-valued. Mr UY originally purchased property P for £560,000. It is now worth £780,000.

Which ONE of the following shows how this transaction should be recorded in Mr UY's property account?

Non-current assets can be divided between intangible and tangible assets.

Which THREE of the following are intangible assets?

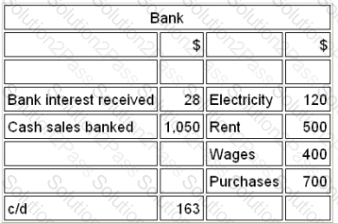

Refer to the Exhibit.

Which of the following would be shown in the trial balance for the bank ledger account?

A trader commenced business with capital of $20,000. At the end of the financial year he had receivables of $10,000, payables of $6,000, inventory of $12,000, cash of $4,000 and non-current assets costing $16,000.

The profit/loss for the period was:

Which one of the following would not be considered one of the roles of a Financial Accountant?

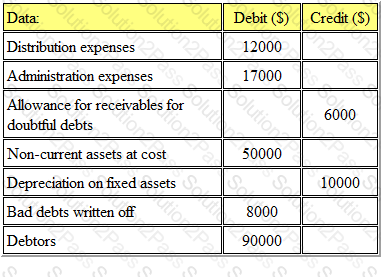

Refer to the exhibit.

The following is an extract from the trial balance of a business for its most recent year:

Gross profit has already been calculated as being $75,000. Depreciation is to be provided at 25% on the reducing balance, and the allowance for receivables for doubtful debts is to be amended to 5% of receivables.

Using some or all of the above figures, the correct net profit is

Which of the following are likely examples of accrued expenses:

What will be the effect on the draft financial statements if the closing inventory figure is increased?

Accountant P debited wages with £1,000 instead of £1,500, but credited sales with £1,500 instead of £2,000.

Which of the following kind of bookkeeping mistakes is this?

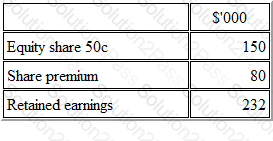

Refer to the exhibit.

ABC has the equity balances at the end of year 1.

During year 2 ABC issues 100,000 new shares at a price of $1.10

What is the balance on share premium at the end of year 2?

Which of the following statements concerning the statements of cashflows are INCORRECT?

A company has a debt/equity ratio of 50%. If the company's total equity is $750,000, what is the gearing ratio for the company?

The accounting concept which states that non-current assets should be valued at cost (or valuation) less accumulated depreciation, rather than their saleable value in the event of closure, is the.

Which one of the following is not an example of an intangible asset?

Goodwill is calculated as being:

Select the THREE INCORRECT statements from the following list of statements about memorandum accounts: