F1 CIMA Financial Reporting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F1 Financial Reporting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

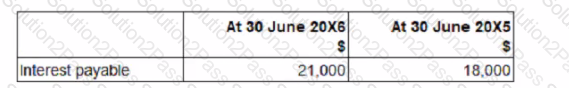

BCD's finance cost for the year ended 30 June 20X6 in its statement of profit or loss is $198,000. BCD's statement of financial position is as follows:

How much will be included in BCD's statement of cash flows for interest paid in the year ended 31 December 20X6?

Give your answer to The nearest $.

TUV owns property that has a carrying amount greater than its original cost due to a revaluation 2 years ago. The property continues to be used by TUV up lo the date of its disposal and is sold for more than its carrying amount.

Which THREE of the following correctly describe the accounting treatment for the disposal of the property?

Which of the following statements about trade payables management is false?

Which of the following correctly identifies the order of the steps involved in the development of an International Financial Reporting Standard prior to it being issued?

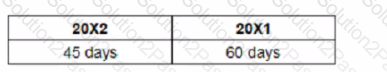

EFG prepares financial statements to 31 December each year. EFG has the following receivable days based on the year end receivable balances:

Which of the following would be a reason for this decrease in receivable days?

When developing local Generally Accepted Accounting Principles (known as local GAAP) some countries start with International Financial Reporting Standards (IFRSs) which are then amended to reflect local needs and conditions.

This type of approach is classified as:

BCD owns an item of plant which cost $20,000 and at the time of purchase was assessed to have a useful economic life of 8 years and a residual value of $2,000

The carrying amount of the plant at 1 January 20X8 is $11,000. On that date BCD's directors estimate that the plant's remaining useful life is now 6 years The residual value remains unchanged at $2,000

What is the depreciation charge for this plant for the year ended 31 December 20X8?

Give your answer to the nearest $.

Why are excise duties an attractive method of raising tax for governments?

Select TWO that apply.

030d49a3-3c4c-45ad-9aee-710302f219f1: Entities normally pay taxation on their worldwide income in the country in which they are deemed to be resident.

Residency is determined by the

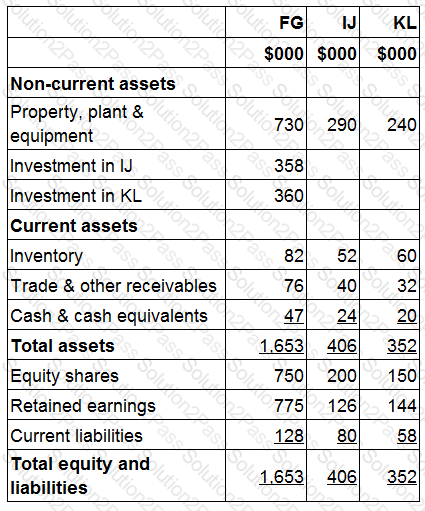

Statements of financial position for FG, IJ and KL at 31 December 20X5 include the following balances:

FG acquired 90% of IJ's equity shares for $358,000 on 1 July 20X5 when IJ's retained earnings were $98,000.

FG acquired 100% of KL's equity shares for $360,000 on 1 January 20X5 when KL's retained earnings were $155,000.

FG used the proportion of net assets method to value non-controlling interests at acquisition.

KL sold a piece of land to FG for $130,000 on 1 September 20X5. At the date of transfer the land had a carrying value of $50,000.

The management of FG expect KL to make profits in the future and no impairment ot its goodwill was proposed at 31 December 20X5.

Calculate the value of property, plant and equipment to be recognized in FG's consolidated statement of financial position at 31 December 20X5.

Give your answer to the nearest whole $.

Which THREE of the following are included within an entity's statement of profit or loss?

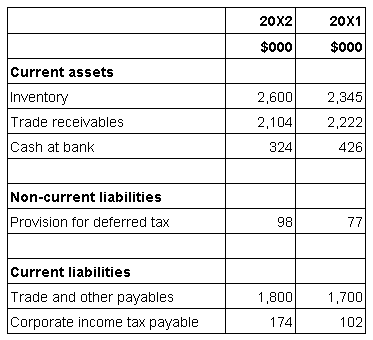

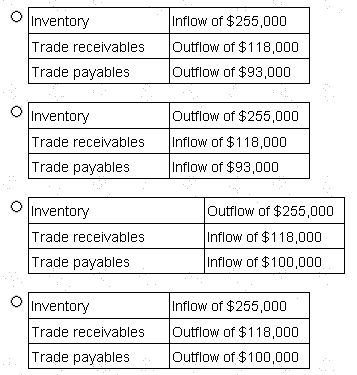

The following information is extracted from OO's statement of financial position at 31 March:

Included in other payables is interest payable of $80,000 at 31 March 20X2 and $73,000 at 31 March 20X1.

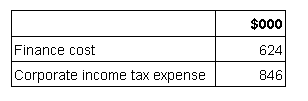

The following information if included within OO's statement of profit or loss for the year ended 31 March 20X2:

Included within finance cost is $124,000 which relates to interest paid on a finance lease. 00 includes finance lease interest within financing activities on its statement of cash flows.________________

Within OO's statement of cash flow for the year ended 31 March 20X2 which figures should be included to reflect the changes in working capital within the net cash flow from operating activities?

What does the tax credit method of giving double taxation relief mean?