F2 CIMA F2 Advanced Financial Reporting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F2 F2 Advanced Financial Reporting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

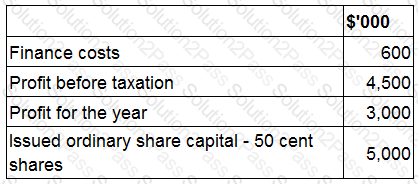

Information from the financial statements of RST for the year ended 30 April 20X9 is as follows:

At 30 April 20X9 the ordinary shares are trading at $4.75.

What is the price earnings (P/E) ratio for RST at 30 April 20X9?

If you were asked to express the overall performance of an entity as a percentage of its total investment in net assets which of the following ratios would you calculate?

A local council is one year into a two year project to renovate local parks. The project is on track to be completed within the set time-scale, however it has proved more costly than initially expected.

The project is on track to be completed within its two year period. Contracts for the labour and materials needed to renovate the parks were agreed at the start of the project and no changes have arisen. Despite the fact

that the council has yet to fully settle these contracts, costs are set to be as budgeted.

Why would this example not be recognised as a provision?

Which of the following taken independently would explain the reduction in the profits as highlighted by the Chairman's press release?

AB, a listed entity, prepared its financial statements to 31 December 20X7, in accordance with international accounting standards.

Which THREE of the following were disclosed as related parties of AB in its financial statements?

MNO has calculated its return on capital employed ratio for 20X4 and 20X5 as 41% and 56% respectively.

Taking each statement in isolation, which would explain the movement in the ratio between the 2 years?

Which of the following reduce the usefulness of ratio analysis when comparing entities that operate in the same industry?

Select ALL that apply.

AB sold the majority of its operating equipment to LM for cash on 30 December 20X9 and then immediately leased it back under an operating lease.

AB used the cash proceeds from the sale to reduce its long term borrowings significantly. No early repayment charge was levied by the lender.

Which of the following statements is true in respect of AB's ratios calculated at 31 December 20X9?

Which of the following is a related party according to the definition of a related party in IAS24 Related Party Disclosures?

On 1 January 20X4 EF grants each of its 125 employees 500 share options on the condition that they remain in employment for 3 years. During the year to 31 December 20X4 10 employees left and It is expected that a further 25 will leave before the end of the vesting period.

The fair value of each share option is $30 on 1 January 20X4 and $45 on 31 December 20X4.

What is the journal entry in respect of these share options in EF's financial statements for the year ended 31 December 20X4?

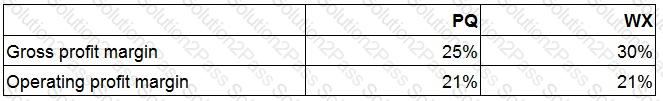

PQ and WX are similar sized entities and operate in the same industry within Country X . Both operate from a single warehouse and have similar levels of non current asset resources.

The following ratios have been calculated at 31 October 20X8:

If considered individually, which of the following would limit the usefulness of these ratios in assessing the comparative financial performances of PQ and WX?

As at 31 October 20X7 TU's financial statements show the entity having profit after tax of $600,000 and 900,000 $1 ordinary shares in issue. There have been no issues of shares during the year. At 31 October 20X7 TU have 300,000 share options in issue, which allow the holders to purchase ordinary shares at $2 a share in 3 years' time. The average price of the ordinary shares throughout the year was $5 a share.

What is the diluted earnings per share for the year ended 31 October 20X7?

AB acquired an investment in a debt instrument on 1 January 20X5 at its nominal value of $25,000, which it intends to hold until maturity. The instrument carried a fixed coupon interest rate of 5%, payable in arrears. Transactions costs of $5,000 were paid in respect of this investment. The effective interest rate applicable to this instrument was estimated at 9%.

Calculate the value of this investment that AB will include in its statement of financial position at 31 December 20X5.

Give your answer to the nearest whole number.

$ ?

XY owned 80% of the equity share capital of AB at 1 January 20X5. XY disposed of 20% of AB's equity share capital on 31 December 20X5 for $200,000. The non controlling interest was measured at $140,000 immediately prior to the disposal.

What was the amount of the credit to retained earnings that XY will process in respect of this disposal when it prepares its consolidated financial statements at 31 December 20X5?

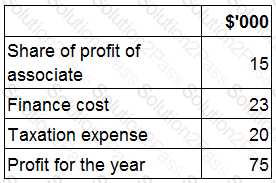

The consolidated statement of profit or loss for VW for the year ended 30 September 20X7 includes the following:

What is VW's interest cover for the year ended 30 September 20X7?

In recent years EBITDA has been adopted by large entities as a key measure of performance. The following figures have been extracted from the financial statements of UV for the year ended 30 November 20X9:

What is EBITDA for UV for the year ended 30 November 20X9?

Give your answer to the nearest $'000.

$ ? 000

Which of the following is the correct calculation for basic earnings per share in accordance with IAS 33 Earnings Per Share?

Which of the following reduce the usefulness of ratio analysis when comparing entities that operate in the same industry? Select ALL that apply.

LM acquired 15% of the equity share capital of ST on 1 January 20X6 for $18 million. LM acquired a further 50% of the equity share capital of ST for $50 million on 1 January 20X7 when the fair value of ST's net assets was $82 million. The original 15% investment in ST had a fair value of $20 million at 1 January 20X7. The non controlling interest in ST was measured at its fair value of $30 million at the date control in ST was acquired.

Calculate the goodwill arising on the acquisition of ST that LM included in its consolidated financial statements at 31 December 20X7.

Give your answer to the nearest $ million.

$ ? million

On 30 November 20X9 OPQ acquires a financial asset that is classified as Available for Sale.

Which of the following describes the value of the financial asset on the date of acquisition?