F3 CIMA Financial Strategy Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F3 Financial Strategy certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

H Company has a fixed rate load at 10.0%, but wishes to swap to variable. It can borrow at LIBOR 8%.

The bank is currently quoting swap rates of 3.1% (bid) and 3.5% (ask).

What net rate will HHH Company pay if it enters into the swap?

A national rail operating company has made an offer to acquire a smaller competitor.

Which of the following pieces of information would be of most concern to the competition authorities?

Formed in 2010, the International Integrated Reporting Council The primary purpose of the IIRC's framework is to help enable an organisation to communicate which of the following'?

A company has two divisions.

A is the manufacturing division and supplies only to B, the retail division.

The Board of Directors has been approached by another company to acquire Division B as part of their retail expansion programme.

Division A will continue to supply to Division B as a retail customer as well as source and supply to other retail customers.

Which is the main risk faced by the company based on the above proposal?

MAN is a manufacturing company that is based in country M and sells almost exclusively to customers in country M, priced in the local currency, M$.

MAN wishes to expand the business by acquiring a company that manufactures similar products but has a more global customer base. It is particularly interested in selling to customers in country P, which uses currency P$ but recognises that the P$ is generally quite volatile against the M$.

Country P uses the same language as country M, has free entry of labour from country M, no exchange controls or withholding tax and a favourable double tax treaty.

Which of the following companies would be most suitable takeover candidates for MAN to investigate further?

A government is currently considering the privatisation of the national airline. The shares are to be offered to the public via a fixed price Initial Public Offering (IPO).

Which THREE of the following statements are correct?

Company WWW is identical in all operating and risk characteristics to Company ZZZ. but their capital structures differ. Company WWW and Company ZZZ both pay corporate income tax at 20%

Company WWW has a gearing ratio (debt: equity) of 1:3 Its pre-tax cost of debt is 6%.

Company ZZZ Is all-equity financed. Its cost of equity is 15%

What is the cost of equity tor Company WWW?

Company AD is planning to acquire Company DC. It is evaluating two methods of structuring the terms of the bid, which will be ether a debt-funded cash offer or a share exchange

The following Information is relevant

• The two companies are of similar size and in related industries

• AB's gearing ratio measured as debt to debt plus equity, is currently 30% based on market values. This Is the company's optimum capital structure set to reflect the risk appetite of shareholders.

• The combined company is expected to generate savings and synergies

Which THREE of the following are advantages to AB's shareholders of a debt-funded cash offer compared with a share exchange?

A listed company has suffered a period of falling revenues and profit margins. It has been obliged to issue a profit warning to the market and its share price has fallen sharply. The company relies heavily on debt finance and is discussing with its banks possible refinancing options to assist with a restructuring programme.

Which THREE of the following are likely to be of MOST interest to the company's banks when they review the refinancing requests?

Company A has just announced a takeover bid for Company B. The two companies are large companies in the same industry_ The bid is considered to be hostile.

Company B's Board of Directors intends to try to prevent the takeover as they do not consider it to be in the best interests of shareholders

Which THREE of the following are considered to be legitimate post-offer defences?

An entity prepares financial statements to 30 June.

During the year ended 30 June 20X2 the following events occurred:

1 July 20X1

• The entitiy borrowed $100 million at a variable rate of interest.

• In order to protect itself against the variability of its interest cashflows, the entity entered into a pay-fixed-receive-variable interest swap with annual settlements. The fair value of the swap on this date was zero.

30 June 20X2

• The entity received a net settlement of $2 million under the swap. After this net settlement, the fair value of the swap was $5 million - a financial asset.

The entity decides to use hedge accounting for this arrangement and has designated it as a cash flow hedge. The swap is a perfect hedge of the variability of the cash interest payments.

Which of the following describes the treatment of the settlement and the change in the fair value of the swap in the statement of profit or loss and other comprehensive income for the year ended 30 June 20X2?

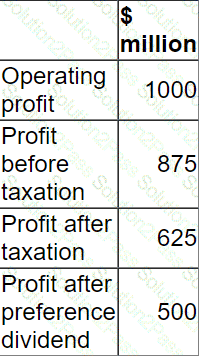

Extracts from a company's profit forecast for the next financial year as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 1,250 million ordinary shares currently in issue and canceling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

Company R is a well-established, unlisted, road freight company.

In recent years R has come under pressure to improve its customer service and has had some cusses in doing this However, the cost of improved service levels has resulted In it marketing small losses in its latest financial year. This is the forest time R has not been profitable.

R uses a’ residual divided policy ad has paid dividends twice in the last 10 years.

Which of the following methods would be most appropriate for valuating R?

Company A is identical in all operating and risk characteristics to Company B, but their capital structures differ.

Company B is all-equity financed. Its cost of equity is 17%.

Company A has a gearing ratio (debt:equity) of 1:2. Its pre-tax cost of debt is 7%.

Company A and Company B both pay corporate income tax at 30%.

What is the cost of equity for Company A?

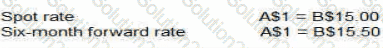

Company A operates in country A with the AS as its functional currency. Company A expects to receive BS500.000 in 6 months' time from a customer in Country B which uses the B$.

Company A intends to hedge the currency risk using a money market hedge

The following information is relevant:

What is the AS value of the BS expected receipt in 6 months' time under a money market hedge?

A listed company in a high growth industry, where innovation is a key driver of success has always operated a residual dividend policy, resulting in volatility in dividends due to periodic significant investments in research and development.

The company has recently come under pressure from some investors to change its dividend policy so that shareholders receive a consistent growing dividend. In addition, they suggested that the company should use more debt finance.

If the suggested change is made to the financial policies, which THREE of the following statements are true?

A company is planning a new share issue.

The funds raised will be used to repay debt on which it is currently paying a high interest rate.

Operating profit and dividends are expected to remain unchanged in the near future.

If the share issue is implemented, which THREE of the following are most likely to increase?

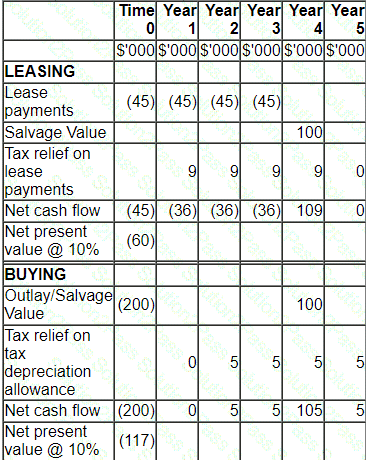

A company plans a four-year project which will be financed by either an operating lease or a bank loan.

Lease details:

• Four year lease contract.

• Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

• The interest rate payable on the bank borrowing is 10%.

• The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

• A salvage or residual value of $100,000 is estimated at the end of the project's life.

• Purchased assets attract straight line tax depreciation allowances.

• Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Which THREE of the following items are errors within the appraisal?

A company financed by equity and debt can be valued by discounting:

Two listed companies in the same industry are joining together through a merger.

What are the likely outcomes that will occur after the merger has happened?

Select ALL that apply.