F3 CIMA Financial Strategy Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F3 Financial Strategy certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Which THREE of the following would be of most interest to lenders deciding whether to provide long-term debt to a company?

A large, listed company in the food and household goods industry needs to raise $50 million for a period of up to 6 months.

It has an excellent credit rating and there is almost no risk of the company defaulting on the borrowings. The company already has a commercial paper programme in place and has a good relationship with its bank.

Which of the following is likely to be the most cost effective method of borrowing the money?

KKL is a listed sports clothing company with three separate business units. KKL is seeking to sell TT’, one of these business units

TTP cwns a new. brand of trail running shoes that have Droved hugely popular with lone distance runners. The management team of TTP are frustrated by the constraints imposes b/ KKL in managing tie brand and developing. the bus ness and they believe that TTF has huge growth potential.

The management team of TTP have approached KKL with a proposal to purchase 1~P through a management layout (MDO). KKL has accepted this proposal as TTP has not proved to be a good fit' with the rest of the business and has agreed on the selling price.

Which THREE of the following factors a-e mast Likely to affect the success of the MBO?

Company C has received an unwelcome takeover bid from Company P.

Company P is approximately twice the size of Company C based on market capitalisation.

Although the two companies have some common business interests, the main aim of the bid is diversification for Company P.

The offer from Company P is a share exchange of 2 shares in Company P for 3 shares in Company C.

There is a cash alternative of $5.50 for each Company C share.

Company C has substantial cash balances which the directors were planning to use to fund an acquisition.

These plans have not been announced to the market.

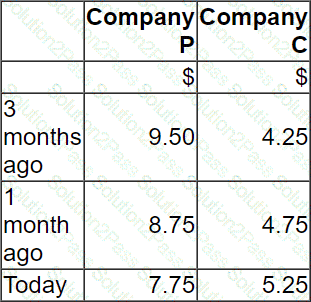

The following share price information is relevant. All prices are in $.

Which of the following would be the most appropriate action by Company C's directors following receipt of this hostile bid?

Company A plans to acquire Company B, an unlisted company which has been in business for 3 years.

It has incurred losses in its first 3 years but is expected to become highly profitable in the near future.

No listed companies in the country operate the same business field as Company B, a unique new high-risk business process.

The future success of the process and hence the future growth rate in earnings and dividends is difficult to determine.

Company A is assessing the validity of using the dividend growth method to value Company B.

Which THREE of the following are weaknesses of using the dividend growth model to value an unlisted company such as Company HHG?

A company is planning a share buyback. In which of the following circumstances would a share buyback be appropriate?

A company is in the process of issuing a 10 year $100 million bond and is considering using an interest rate swap to change the interest profile on some or all of the $100 million new finance.

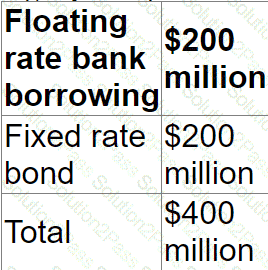

The company has a target fixed versus floating rate debt profile of 1:1. Before issuing the bond its debt profile was as follows:

Which of the following is the most appropriate interest rate swap structure for the company?

Which THREE of the following are likely to be strategic reasons for a horizontal acquisition?

A company is valuing its equity prior to an initial public offering (IPO).

Relevant data:

• Earnings per share $1.00

• WACC is 8% and the cost of equity is 12%

• Dividend payout ratio 40%

• Dividend growth rate 2% in perpetuity

The current share price using the Dividend Valuation Model is closest to:

A venture capitalist invests in a company by means of buying:

• 9 million shares for $2 a share and

• 8% bonds with a nominal value of $2 million, repayable at par in 3 years' time.

The venture capitalist expects a return on the equity portion of the investment of at least 20% a year on a compound basis over the first 3 years of the investment.

The company has 10 million shares in issue.

What is the minimum total equity value for the company in 3 years' time required to satisify the venture capitalist's expected return?

Give your answer to the nearest $ million.

$ million.

If a company's bonds are currently yielding 8% in the marketplace, why would the entity's cost of debt be lower than this?

A geared and profitable company is evaluating the best method of financing the purchase of new machinery. It is considering either buying the machinery outright, financed by a secured bank borrowing and selling the machinery at the end of a fixed period of time or obtain the machinery under a lease for the same period of time.

Which is the correct discount rate to use when discounting the incremental cash flows of the lease against those of the buy and borrow alternative?

Which of the following statements best describes a residual dividend policy?

Which THREE of the following statements about stock market listings are correct?

Companies A, B, C and D:

• are based in a country that uses the K$ as its currency.

• have an objective to grow operating profit year on year.

• have the same total levels of revenue and cost.

• trade with companies or individuals in the eurozone. All import and export trade with companies or individuals in the eurozone is priced in EUR.

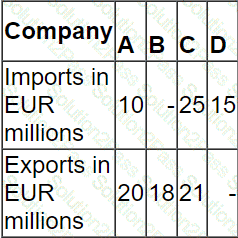

Typical import/export trade for each company in a year are as follows:

Which company's growth objective is most sensitive to a movement in the EUR/K$ exchange rate?

Company A is located in Country A, where the currency is the A$.

It is listed on the local stock market which was set up 10 years ago.

It plans a takeover of Company B, which is located in Country B where the currency is the B$, and where the stock market has been operating for over 100 years.

Company A is considering how to finance the acquisition, and how the shareholders of Company B might respond to a share exchange or cash (paid in B$).

Which of the following is likely to explain why the shareholders of Company B would prefer a share exchange as opposed to a cash offer?

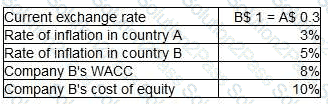

Company A operates in country A and uses currency AS. It is looking to acquire Company B which operates in country B and uses currency B$. The following information is relevant:

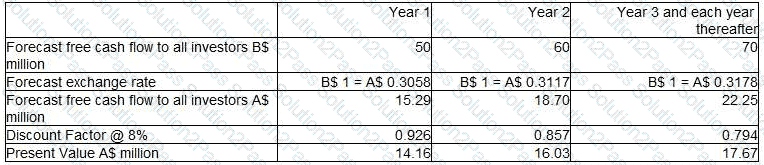

The assistant accountant at Company A has prepared the following valuation of company B's equity, however there are some errors in his calculations.

Value of Company B's equity = 14.16 + 16.03 + 17.67 = AS47.86 million

Company B has BS5 million of debt finance.

Which of the following THREE statements are true?

Company RRR is a well-established, unlisted, road freight company.

In recent years RRR has come under pressure to improve its customer service and has had some success in doing this However, the cost of improved service levels has resulted in it making small losses in its latest financial year. This is the first time RRR has not been profitable.

RRR uses a 'residual' dividend policy and has paid dividends twice in the last 10 years.

Which of the following methods would be most appropriate for valuing RRR?

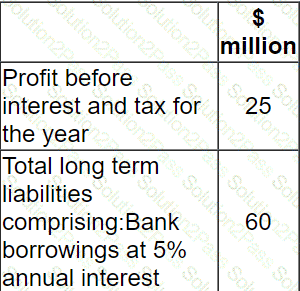

At the last financial year end, 31 December 20X1, a company reported:

The corporate income tax rate is 30% and the bank borrowings are subject to an interest cover covenant of 4 times.

The results are presently comfortably within the interest cover covenant as they show interest cover of 8.3 times. The company plans to invest in a new product line which is not expected to affect profit in the first year but will require additional borrowings of $20 million at an annual interest rate of 10%.

What is the likely impact on the existing interest cover covenant?

Using the CAPM, the expected return for a company is 10%. The market return is 7% and the risk free rate is 1%.

What does the beta factor used in this calculation indicate about the risk of the company?