F3 CIMA Financial Strategy Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F3 Financial Strategy certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A company has just received a hostile bid. Which of the following response strategies could be considered?

Company A plans to acquire Company B.

Both firms operate as wholesalers in the fashion industry, supplying a wide range of ladies' clothing shops.

Company A sources mainly from the UK, Company B imports most of its supplies from low-income overseas countries.

Significant synergies are expected in management costs and warehousing, and in economies of bulk purchasing.

Which of the following is likely to be the single most important issue facing Company A in post-merger integration?

Assume today is 31 December 20X1.

A listed mobile phone company has just launched a new phone which is proving to be a great success.

As a direct result of the product's success, earnings are forecast to increase by:

• 5% a year in each of years 20X2 – 20X6

• 3% from 20X7 onwards

Market analysts were very excited to hear the news of the success of the product and future growth forecasts.

Assuming a semi-efficient market applies, which of the following company valuation methods is likely to give the best estimate of the company's equity value today?

A product costs USD10 when purchased in the USA. The same product costs USD12 when it is purchased in the UK and the price in GBP is convened to USD.

Which of the following statement concerning purchasing power parity is correct?

Which THREE of the following would be most important if a hospital wishes to review the effectiveness of its services?

XYZ is a multi-national group with subsidiary AA in Country A and subsidiary BB in Country B. The capital structures of AA and BB are set up to take advantage of the lower tax rate in Country A Thin capitalisation rules in Country B will limit the ability for either AA or BB to claim tax relief on:

A company's Board of Directors is considering raising a long-term bank loan incorporating a number of covenants.

The Board members are unsure what loan covenants involve.

Which THREE of the following statements regarding loan covenants are true?

The long-term prospects for inflation in the UK and the USA are 1% and 4% per annum respectively.

The GBP/USD spot rate is currently GBP/USD1.40

Using purchasing power parity theory, what GBP/USD spot rate would you expect to see in six months’ time?

A company generates operating profit of $17.2 million, and incurs finance costs of $5.7 million.

It plans to increase interest cover to a multiple of 5-to-1 by raising funds from shareholders to repay some existing debt. The pre-tax cost of debt is fixed at 5%, and the refinancing will not affect this.

Assuming no change in operating profit, what amount must be raised from shareholders?

Give your answer in $ millions to the nearest one decimal place.

$ ?

Which THREE of the following are benefits of integrated reporting?

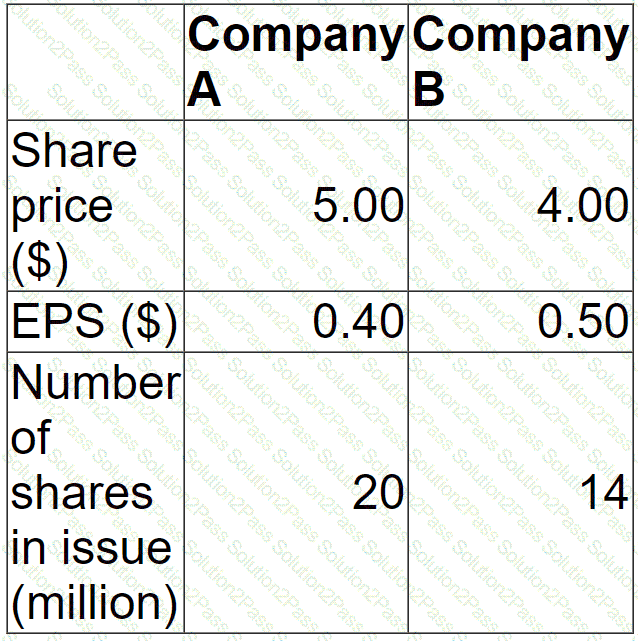

Company A is planning to acquire Company B at a price of $ 65 million by means of a cash bid.

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

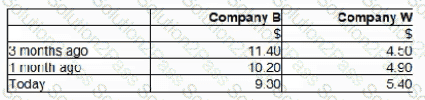

Company W has received an unwelcome takeover bid from Company B. The offer is a share exchange of 3 shares in Company B for 5 shares in Company W or a cash alternative of $5.70 for each Company W share.

Company B is approximately twice the size of Company W based on market capitalisation. Although the two companies have some common business interested the main aim of the bid is diversification for Company B.

Company W has substantial cash balances which the directors were planning to use to fund an acquisition. These plans have not been announced to the market.

The following share price information is relevant.

Which of the following would be the most appropriate action by Company W's directors following receipt of this hostile bid?

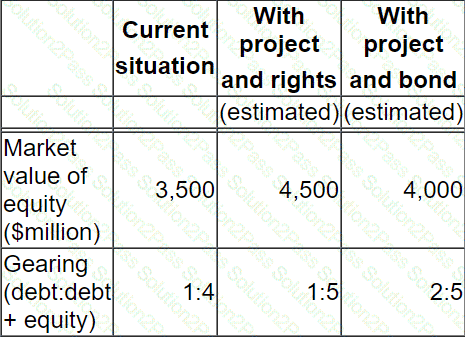

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

Holding cash in excess of business requirements rather than returning the cash to shareholders is most likely to result in lower:

The Government of Eastland is concerned that competition within its private healthcare industry is being distorted by the dominant position of the market leader, Delta Care. The Government has instructed the industry regulator to investigate whether the industry is operating fairly in the interests of patients.

Which of the following factors might the industry regulator review as part of their investigation?

Select ALL that apply.

A listed company is considering either a one-off special divided or a share repurchase scheme to reduce its surplus cash level.

Identify TWO advantages that a one-off special payment has over a share repurchase scheme.

Company ABD and Company BCD operate in the same industry and each has a significant market share.

The directors of Company ABD have heard rumours in the market that Company BCD is planning to bid to takeover Company ABD. They do not believe the takeover would be in the best interests of the shareholders and are therefore keen to prevent the bid from going ahead.

Which THREE of the following defense strategies could be used by the directors of Company ABD at this point in time?

A private company manufactures goods for export, the goods are priced in foreign currency B$.

The company is partly owned by members of the founding family and partly by a venture capitalist who is helping to grow the business rapidly in preparation for a planned listing in three years' time.

The company therefore has significant long term exposure to the B$.

This exposure is hedged up to 24 months into the future based on highly probable forecast future revenue streams.

The company does not apply hedge accounting and this has led to high volatility in reported earnings.

Which of the following best explains why external consultants have recently advised the company to apply hedge accounting?

An unlisted company which is owned and managed by its original founders has accumulated excess cash following many years of profitable trading.

The Board of Directors is comprised of the four original founders who each hold 25% of the equity share capital.

Which THREE of the following will be significant considerations when deciding on the company's dividend policy?

A company has a financial objective of maintaining a gearing ratio of between 30% and 40%, where gearing is defined as debt/equity at market values.

The company has been affected by a recent economic downturn leading to a shortage of liquidity and a fall in the share price during 20X1.

On 31 December 20X1 the company was funded by:

• Share capital of 4 million $1 shares trading at $4.0 per share.

• Debt of $7 million floating rate borrowings.

The directors plan to raise $2 million additional borrowings in order to improve liquidity.

They expect this to reassure investors about the company's liquidity position and result in a rise in the share price to $4.2 per share.

Is the planned increase in borrowings expected to help the company meet its gearing objective?