F3 CIMA Financial Strategy Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F3 Financial Strategy certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

PTT has a number of subsidiary companies around the world, including FTT based in Europe and CTT based in Indonesia

CTT purchases all of us raw materials from FTT CTT processes these materials and the resulting products are exported to several different countries CTT pays FTT in the Indonesian currency.

Indonesia's inflation is higher than that of FTTs home country

Which of the following statements are correct?

Select ALL that apply

A consultancy company is dependent for profits and growth on the high value individuals it employs.

The company has relatively few tangible assets.

Select the most appropriate reason for the net asset valuation method being considered unsuitable for such a company.

NNN is a company financed by both equity and debt. The directors of NNN wish to calculate a valuation of the company's equity and at a recent board meeting discussed various methods of business valuation.

Which THREE of the following are appropriate methods for the directors of NNN to use in this instance?

Company YZZ has made a bid for the entire share capital of Company ZYY

Company YZZ is offering the shareholders in Company ZYY the option of either a share exchange or a cash alternative

Which THREE of the following would be considered disadvantages of accepting the cash consideration for the shareholders of Company ZYY?

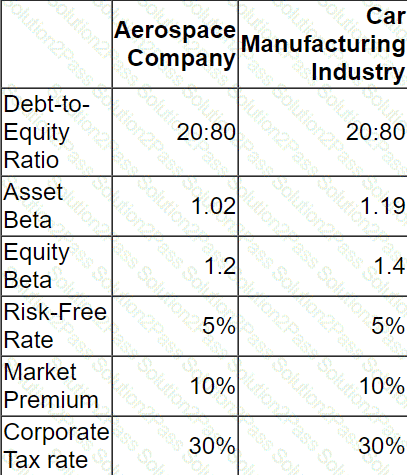

An aerospace company is planning to diversify into car manufacturing.

Relevant data:

What is the the cost of equity to be used in the WACC for the project appraisal?

Give your answer in percentage, as a whole number.

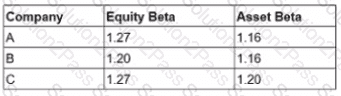

Three companies are quoted on the New York Stock Exchange. The following data applies:

Which of the following statements is TRUE?

VVV has a floating rate loan that it wishes to replace with a fixed rate. The cost of the existing loan is the risk-free rate + 3%. VW would have to pay a fixed rate of 7% on a fixed rate loan VVVs bank has found a potential counterparty for a swap arrangement.

The counterparty wishes to raise a variable rate loan It would pay the risk-free rate +1 % on a variable rate loan and 8% on a fixed rate.

The bank will require 10% of the savings from the swap and WV and the counterparty will share the remaining saving equally.

Calculate VWs effective rate of interest from this swap arrangement.

In the context of the Integrated Reporting

A company gas a large cash balance but its directors have been unable to identify any positive NPV projects to invest in. Which THREE of the following are advantages of a share repurchase, compared with a one-off large dividend?

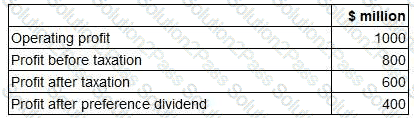

Extracts from a company's profit forecast for the next financial year is as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 2,000 million ordinary shares currently in issue and cancelling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

Delta and Kappa both wish to borrow $50m.

Delta can borrow at a fixed rate of 12% or at a floating rate of the risk-free rate +3%

Kappa can borrow at 15% fixed or the risk-free rate +4%.

Delta wishes a variable rate loan and Kappa a fixed rate loan The bank for the two companies suggests a swap arrangement The two companies agree to a swap arrangement, sharing savings equally

What is the effective swap rate for each company?

Company A is based in country A with the AS as its functional currency. It expects to receive BS20 million from Company B in settlement of an export invoice.

The current exchange rate is A$1 =B$2 and the daily standard deviation of this exchange rate = 0 5%

What is the one-day 95% VaR in AS?

A young, capital intensive company has a large amount of tangible assets.

Intangibles, including brand name, are considered to be of negligible value at this time

Relevant data:

• The company operates a residual dividend policy.

• The industry in which the company operates is suffering from a large amount of uncertainty at present. Forecasting the future earnings or cashflows of the company is therefore extremely difficult

• There are very few quoted companies in the industry that are similar in size or in precisely the same business sectors.

Which method of valuation would be most suitable for this company?

The Board of Directors of a listed company is considering the company's dividend/retentions policy.

The inflation rate in the economy is currently high and is expected to remain so for the foreseeable future.

The board are unsure what impact the high level of inflation might have on the dividend policy.

Which THREE of the following statements are true?

An unlisted company is attempting to value its equity using the dividend valuation model.

Relevant information is as follows:

• A dividend of $500,000 has just been paid.

• Dividend growth of 8% is expected for the foreseeable future.

• Earnings growth of 6% is expected for the foreseeable future.

• The cost of equity of a proxy listed company is 15%.

• The risk premium required due to the company being unlisted is 3%.

The calculation that has been performed is as follows:

Equity value = $540,000 / (0.18 - 0.08) = $5,400,000

What is the fault with the calculation that has been performed?

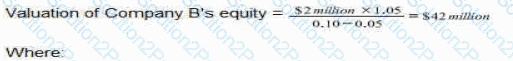

Listed Company A has prepared a valuation of an unlisted company. Company B. to achieve vertical integration Company A is intending to acquire a controlling interest in the equity of Company B and therefore wants to value only the equity of Company B.

The assistant accountant of Company A has prepared the following valuation of Company B's equity using the dividend valuation model (DVM):

Where:

• S2 million is Company B's most recent dividend

• 5% is Company B's average dividend growth rate over the last 5 years

• 10% is a cost of equity calculated using the capital asset pricing model (CAPM), based on the industry average beta factor

Which THREE of the following are valid criticisms of the valuation of Company B's equity prepared by the assistant accountant?

Company A has a cash surplus.

The discount rate used for a typical project is the company's weighted average cost of capital of 10%.

No investment projects will be available for at least 2 years.

Which of the following is currently most likely to increase shareholder wealth in respect of the surplus cash?

A company has a covenant on its 5% long-term bond, stipulating that its retained earnings must not fall below $2 million.

The company has 100 million shares in issue.

Its most recent dividend was $0.045 per share. It has committed to grow the dividend per share by 4% each year.

The nominal value of the bond is $60 million. It is currently trading at 80% of its nominal value.

Next year's earnings before interest and taxation are projected to be $11.25 million.

The rate of corporate tax is 20%.

If the company increases the dividend by 4%, advise the Board of Directors if the level of retained earnings will comply with the covenant?

Which of the following statements is true of a spin-off (or demerger)?

Company T is a listed company in the retail sector.

Its current profit before interest and taxation is $5 million.

This level of profit is forecast to be maintainable in future.

Company T has a 10% corporate bond in issue with a nominal value of $10 million.

This currently trades at 90% of its nominal value.

Corporate tax is paid at 20%.

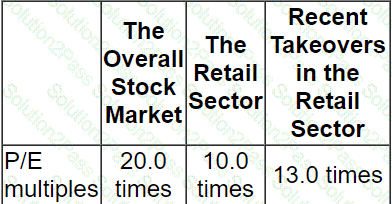

The following information is available:

Which of the following is a reasonable expectation of the equity value in the event of an attempted takeover?