F3 CIMA Financial Strategy Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA F3 Financial Strategy certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A company in country T is considering either exporting its product directly to customers in country P or establishing a manufacturing subsidiary in country P.

The corporate tax rate in country T is 20% and 25% tax depreciation allowances are available

Which TIIRCC of the following would be considered advantages of establishing a subsidiary in country T?

STU has relatively few tangible assets and is dependent for profits and growth on the high-value individuals it employs. Which of the following statements best explains why the net asset valuator method’s considered unstable for TU?

LPM Company is based in Country C. whose currency is the CS

It has entered Into a contract to buy a machine in three months' time. The supplier is overseas and the payment is to be made in a different currency from the CS

The treasurer at LPM Company is considering using a money market hedge to manage the transaction risk associated with a payment.

The assumptions of interest rate parity apply

Which THREE of the following statements concerning the use of a money market hedge for this supplier payment are correct?

A company has 6 million shares in issue. Each share has a market value of $4.00.

$9 million is to be raised using a rights issue.

Two directors disagree on the discount to be offered when the new shares are issued.

• Director A proposes a discount of 25%

• Director B proposes a discount of 30%

Which THREE of the following statements are most likely to be correct?

A company is financed by debt and equity and pays corporate income tax at 20%.

Its main objective is the maximisation of shareholder wealth.

It needs to raise $200 million to undertake a project with a positive NPV of $10 million.

The company is considering three options:

• A rights issue.

• A bond issue.

• A combination of both at the current debt to equity ratio.

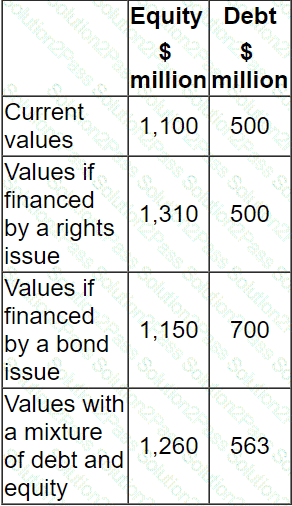

Estimations of the market values of debt and equity both before and after the adoption of the project have been calculated, based upon Modigliani and Miller's capital theory with tax, and are shown below:

Under Modigliani and Miller's capital theory with tax, what is the increase in shareholder wealth?

A company is located in a single country. The company manufactures electrical goods for export and for sale in its home country. When exporting, it invoices in its customers' currency. What currency risks is the company exposed to?

Which three of the following are most likely be primary objectives for a newly established, unincorporated entity in the service sector?

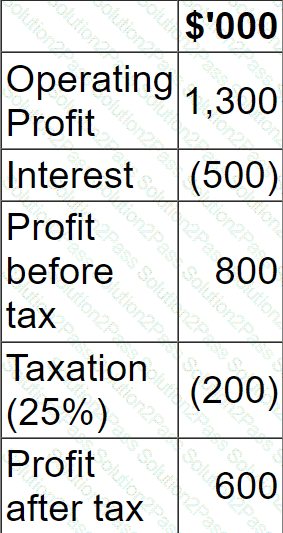

A company has forecast the following results for the next financial year:

The following is also relevant:

• Profit after tax for the year can be assumed to be equivalent to free cash flow for the year.

• Debt finance comprises a $10 million floating rate loan which currently carries an interest rate of 5%.

• $400,000 investment in non-current assets is required to achieve required growth, all of which is to financed from next year's free cash flow.

• The company plans to pay a dividend of $150,000 next year, financed from next year's free cash flow.

The company is concerned that interest rates could rise next year to 6% which could then affect their investment plans.

If interest rates were to rise to 6% and the company wishes to maintain its dividend amount, the planned investment expenditure will decrease by:

The Treasurer of Z intends to use interest rate options to set an interest rate cap on Z’s borrowings.

Which of the following statement is correct?

A company is undertaking a lease-or-buy evaluation, using the post-tax cost of bank borrowing as the discount rate.

Details of the two alternatives are as follows:

Buy option:

• To be financed by a bank loan

• Tax depreciation allowances are available on a reducing-balance basis

• Assets depreciated on a straight-line basis

Lease option:

• Finance lease

• Maintenance to be paid by the lessee

• Tax relief available on interest payments and book depreciation

Which THREE of the following are relevant cashflows in the lease-or-buy appraisal?

Company ABC is planning to bid for company DDD, an unlisted company in an unrelated industry sector to ABC.

The directors of ABC are considering a number of different valuation methods for DDD before making a bid.

Which of the following is the MOST appropriate method for ABC to use to value DDD?

A company wishes to raise additional debt finance and is assessing the impact this will have on key ratios.

The following data currently applies:

• Profit before interest and tax for the current year is $500,000

• Long term debt of $300,000 at a fixed interest rate of 5%

• 250,000 shares in issue with a share price of $8

The company plans to borrow an additional $200,000 on the first day of the year to invest in new project which will improve annual profit before interest and tax by $24,000.

The additional debt would carry an interest rate of 3%.

Assume the number of shares in issue remain constant but the share price will increase to $8.50 after the investment.

The rate of corporate income tax is 30%.

After the investment, which of the following statements is correct?

A listed company follows a policy of paying a constant dividend. The following information is available:

• Issued share capital (nominal value $0.50) $60 million

• Current market capitalisation $480 million

The shareholders are requesting an increased dividend this year as earnings have been growing. However, the directors wish to retain as much cash as possible to fund new investments. They therefore plan to announce a 1-for-10 scrip dividend to replace the usual cash dividend.

Assuming no other influence on share price, what is the expected share price following the scrip dividend?

Give your answer to 2 decimal places.

$ ?

Country X's short-term interest rates are slightly higher than its long-term rates. Which THREE of the following statements are correct?

A company's dividend policy is to pay out 50% of its earnings.

Its most recent earnings per share was $0.50, and it has just paid a dividend per share of $0.25.

Currently, dividends are forecast to grow at 2% each year in perpetuity and the cost of equity is 10.5%.

In order to grow its earnings and dividends, the company is considering undertaking a new investment funded entirely by debt finance. If the investment is undertaken:

• Its cost of equity will immediately increase to 12% due to the increased finance risk.

• Its earnings and dividends will immediately commence growing at 4% each year in perpetuity.

Which of the following is the expected percentage change in the share price if the new investment is undertaken?

Z wishes to borrow at a floating rate and has been told that it can use swaps to reduce the effective interest rate it pays. Z can borrow floating at Libor ' 1, and fixed at 10%.

Which of the following companies would be the most appropriate for Z to enter into a swap with?

A listed company in the retail sector has accumulated excess cash.

In recent years, it has experienced uncertainly with forecasting the required level of cash for capital expenditure due to unpredictable economic cycles.

Its excess cash is on deposit earning negligible returns.

The Board of Directors is considering the company's dividend policy, and the need to retain cash in the company.

Which THREE of the following are advantages of retaining excess cash in the company?