F3 CIMA Financial Strategy Free Practice Exam Questions (2025 Updated)

Prepare effectively for your CIMA F3 Financial Strategy certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Company P is a pharmaceutical company listed on an alternative investment market.

The company is developing a new drug which it hopes to market in approximately six years' time.

Company P is owned and managed by a group of doctors who wish to retain control of the company. The company operates from leased laboratories with minimal fixed assets.

Its value comes from the quality of its research staff and their research.

The company currently has one approved drug which generates sufficient cashflow to cover day to day operations but not sufficient for major new research and development.

Company P wish to raise debt finance to develop the new drug.

Recommend which of the following types of debt finance would be most appropriate for Company P to help finance the development of this new drug.

A new company was set up two years ago using the personal financial resources of the founders.

These funds were used to acquire suitable premises.

The company has entered into a long-term lease on the premises which are not yet fully fitted out.

The founders are considering requesting loan finance from the company's bank to fund the purchase of custom-made advanced technology equipment.

No other companies are using this type of equipment.

The company expects to continue to be profitable for the forseeable future.

It re-invests some of its surplus cash in on-going essential research and development.

Which THREE of the following features are likely to be considered negatives by the bank when assessing the company's credit-worthiness?

A large multi-divisional company in the food processing and distribution business is conducting a strategic review. The divisions all compete in the same market.

The sale of one of its underperforming food processing divisions to the divisional management team is currently being considered. The purchase by the divisional management team will require venture capital finance.

Which THREE of the following are likely to influence the multi-divisional company's decision on whether or not to sell the under-performing division to the management team?

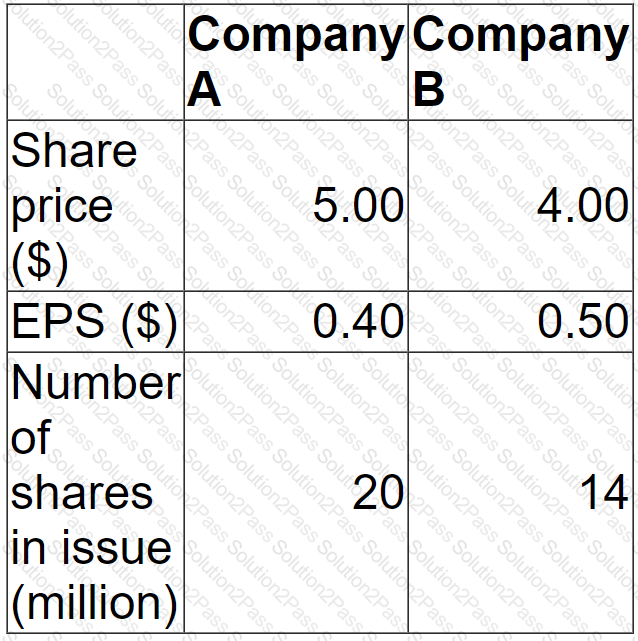

Company A is planning to acquire Company B at a price of $ 65 million by means of a cash bid.

Company A is confident that the merged entity can achieve the same price earnings ratio as that of Company A.

What does Company A expect the value of the merged entity to be post acquisition?

A listed company in a high growth industry, where innovation is a key driver of success has always operated a residual dividend policy, resulting in volatility in dividends due to periodic significant investments in research and development.

The company has recently come under pressure from some investors to change its dividend policy so that shareholders receive a consistent growing dividend. In addition, they suggested that the company should use more debt finance.

If the suggested change is made to the financial policies, which THREE of the following statements are true?

Company A is a large listed company, with a wide range of both institutional and private shareholders.

It is planning a takeover offer for Company B.

Company A has relatively low cash reserves and its gearing ratio of 40% is higher than most similar companies in its industry.

Which TWO of the following would be the most feasible ways of Company A structuring an offer for Company B?

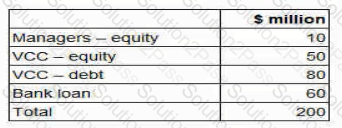

A company intends to sell one of its business units. Company W, by a management buyout (MBO). A selling price of S200 million has been agreed.

The managers are discussing with a bank and a venture capital company (VCC) the following financing proposal.

The VCC requires a minimum return on its equity investment In the MBO of 35% a year on a compound basis over 5 years. What is the minimum total equity value of Company W in 5 years time in order to meet the VCC's required return? Give your answer to one decimal place.

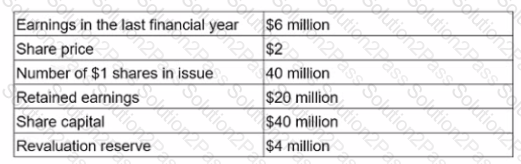

An unlisted company has the following data:

A listed company in the same industry has a P/E of 11.

The value of the unlisted company based on the P/E of this listed company is:

Give your answer to the nearest whole number.

Which of the following statements about the tax impact on debt finance is correct?

A company with a market capitalisation of S50million is considering raising $1 million debt to fund a new 10-year capital investment protect

The value of this issue is considered to be small in comparison to the company's market capitalisation

The company is considering whether to raise the debt finance by either a "bond private placing' or a 'public bond issue.

Which THREE of the following statements are correct?