P1 CIMA Management Accounting Free Practice Exam Questions (2025 Updated)

Prepare effectively for your CIMA P1 Management Accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

The term ‘budgetary slack’ refers to the:

A company is preparing its annual budget and is estimating the number of units of Product A that it will sell in each quarter of year 2. Past experience has shown that the trend for sales of the product is represented by the following relationship:

y = a + bx where

y = number of sales units in the quarter a = 10,000 units b = 3,000 units x = the quarter number where 1 = quarter 1 of year 1

Actual sales of Product A in Year 1 were affected by seasonal variations and were as follows:

Quarter 1:14,000 units Quarter2: 18,000 units Quarter 3: 18,000 units Quarter 4: 20,000 units

Calculate the expected sales of Product A (in units) for each quarter of year 2, after adjusting for seasonal variations using the additive model.

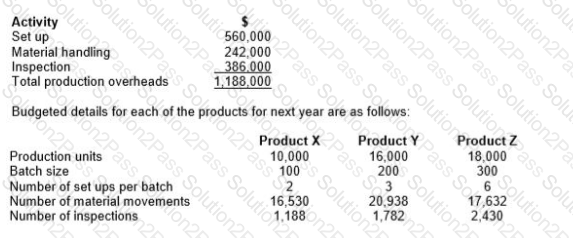

EF manufactures and sells three products, X, Y and Z. The following production overhead costs are budgeted for next year:

Required:

Calculate the total budgeted production overhead cost for each product using activity based budgeting.

5c0e02ae-e691-41dd-b436-d41e2edaf83f: A company is using relevant costing to evaluate a make or buy decision.

The company already has a machine on an operating lease which can be used to make the product.

How would the lease rental cost be classified?

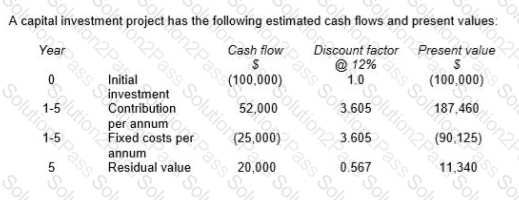

Select the benefits to a company of using sensitivity analysis in investment appraisal.

(Select all the true statements.)

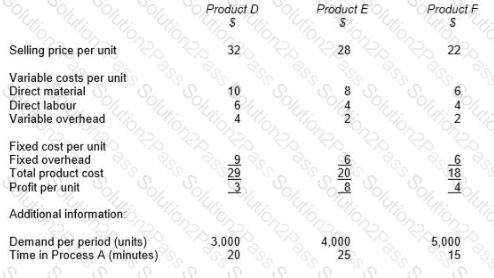

A company produces three products D, E and F. The statement below shows the selling price and product costs per unit for each product, based on a traditional absorption costing system.

Each of the products is produced using Process A which has a maximum capacity of 2,500 hours per period.

If a throughput accounting approach is used, the ranking of products, in order of priority, for the profit maximizing product mix will be:

A small manufacturing company makes a single product. Direct labour costs and factory rent account for 80% and 15% of total cost respectively. Activity levels have not varied by more than 5% for a number of years and there is no evidence of operational inefficiency.

Which of the following is the most appropriate approach to budgeting for this company?

A company operates a customer complaints department.

How will the cost of the customer complaints department be classified in a system focussed on quality related costs?

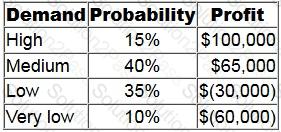

JDM is considering whether to go ahead with the launch of a new product. Profit from the new product is dependent on the level of demand.

The following table shows the estimated profits and their respective probabilities at different levels of demand.

The company could still cancel the launch of the product but would incur a cost of $7,000.

What is the maximum amount that the company should pay for perfect information about demand for the product?

A company develops computer software programs to meet each client's specific requirements. The management accountant is considering introducing a standard costing system.

Which THREE of the following are reasons that support the case for the company's introduction of a standard costing system?

A company manufactures two products and has two production constraints.

When the graphical approach to linear programming is used, the axes of the graph will show:

N prepares budgets on an annual basis by using the budget from the previous year, and then adjusting it for growth and inflation.

This is an example of:

CDF is a manufacturing company within the DF group. CDF has been asked to provide a quotation for a contract for a new customer and is aware that this could lead to further orders. As a consequence, CDF will produce the quotation by using relevant costing instead of its usual method of full cost plus pricing. The following information has been obtained in relation to the contract: Material D 40 tons of material D would be required. This material is in regular use by CDF and has a current purchase price of $38 per ton. Currently, there are 5 tons in inventory which cost $35 per ton. The resale value of the material in inventory is $24 per ton.

Components 4,000 components would be required. These could be bought externally for $15 each or alternatively they could be supplied by RDF, another company within the DF manufacturing group. The variable cost of the component if it were manufactured by RDF would be $8 per unit, and RDF adds 30% to its variable cost to contribute to its fixed costs plus a further 20% to this total cost in order to set its internal transfer price. RDF has sufficient capacity to produce 2,500 components without affecting its ability to satisfy its own external customers. However, in order to make the extra 1,500 components required by CDF, RDF would have to forgo other external sales of $50,000 which have a contribution to sales ratio of 40%.

Labour hours 850 direct labour hours would be required. All direct labour within CDF is paid on an hourly basis with no guaranteed wage agreement. The grade of labour required is currently paid $10 per hour, but department W is already working at 100% capacity. Possible ways of overcoming this problem are: • Use workers in department Z, because it has sufficient capacity. These workers are paid $15 per hour. • Arrange for sub-contract workers to undertake some of the other work that is performed in department W. The sub-contract workers would cost $13 per hour.

Specialist machine The contract would require a specialist machine. The machine could be hired for $15,000 or it could be bought for $50,000. At the end of the contract if the machine were bought, it could be sold for $30,000. Alternatively, it could be modified at a cost of $5,000 and then used on other contracts instead of buying another essential machine that would cost $45,000. The operating costs of the machine are payable by CDF whether it hires or buys the machine. These costs would total $12,000 in respect of the new contract.

Supervisor The contract would be supervised by an existing manager who is paid an annual salary of $50,000 and has sufficient capacity to carry out this supervision. The manager would receive a bonus of $500 for the additional work.

Development time 15 hours of development time at a cost of $3,000 have already been worked in determining the resource requirements of the contract.

Fixed overhead absorption rate CDF uses an absorption rate of $20 per direct labour hour to recover its general fixed overhead costs. This includes $5 per hour for depreciation.

Calculate the relevant cost of the contract to CDF. You must present your answer in a schedule that clearly shows the relevant cost value for each of the items identified above. You should also explain each relevant cost value you have included in your schedule and why any values you have excluded are not relevant.

Ignore taxation and the time value of money.

Select all the true statements.

A museum charges a reduced entrance fee for students in full-time education. The budgeted cost per customer is the same regardless of the entrance fee paid.

4,000 customers were budgeted to visit the museum during period 6, with 25% of customers paying the reduced fee.

3,000 customers visited the museum during period 6 and 1,000 of these paid the reduced entrance fee. Costs were as budgeted but the actual full-priced entrance fee was $2 higher than budgeted.

Which of the following statements is true?

A company operates a standard costing system.

The company combines two raw materials in a process in order to produce a finished product. During month 6 the direct material mix variance was favourable and the direct material yield variance was adverse.

Which of the following statements would explain both of the variances?

Assume that you have made profit calculations based on standard profit calculation methods and activity based costing methods.

In which ways will this information be beneficial to the management team?

Select all the true statements.

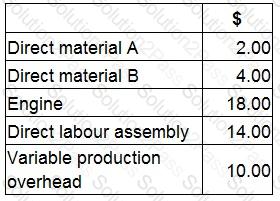

A company manufactures a machine. The machine is made from two types of raw material and is assembled in a factory using skilled labour. The engine for the machine is purchased from an outside supplier.

The following costs relate to the manufacture of one machine:

What is the finished goods inventory valuation for one machine using throughput costing?

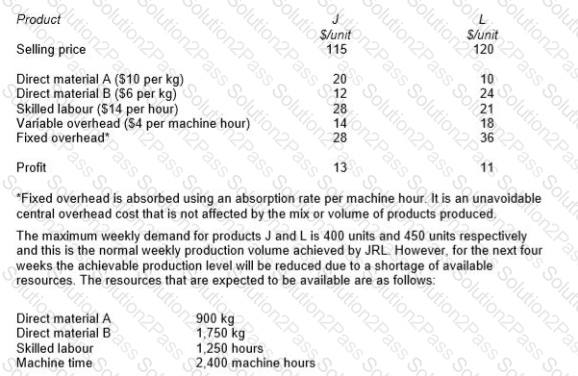

JRL manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

Identify, using graphical linear programming, the weekly production schedule for products J and L that will maximize the profits of JRL during the next four weeks.

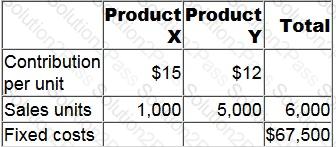

A company sells two products, X and Y, which are always sold in the same ratio.

No inventories are held.

The following budgeted data relate to month 10:

What is the budgeted margin of safety in month 10?

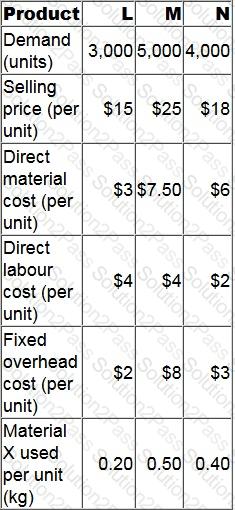

FG Enterprises manufactures and sells three products. There are 4,400 kg of Material X available in the next period. Material X is used in the manufacture of all three products. The following data is available for the next period.

What is the optimal production plan for the next period in order to maximise profit?