P1 CIMA Management Accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA P1 Management Accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

A company’s budget for the next period shows that it would breakeven at sales revenue of $800,000 and fixed costs of $320,000.

The sales revenue needed to achieve a profit of $200,000 in the next period would be:

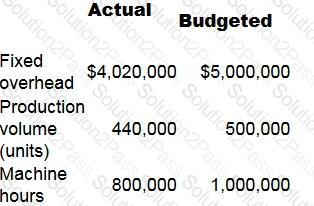

Company Y absorbs fixed production overheads using a rate per machine hour. Budgeted and actual data for month 8 are as follows:

What is the fixed production overhead efficiency variance?

In short-term decision making, which TWO of the following are relevant costs?

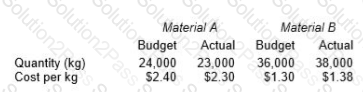

A company produces a product that requires two materials, Material A and Material B. Details of the material quantities and costs for August are given in the table below.

Budgeted and actual output of the product for August was 12,000 units.

The material mix variance for August is:

‘Public sector organizations are often judged by their economy, efficiency and effectiveness. Consequently, they should use an approach to budgeting other than incremental budgeting.’

Required:

Explain ONE advantage and TWO disadvantages of public sector organizations using incremental budgeting.

Select all true statements.

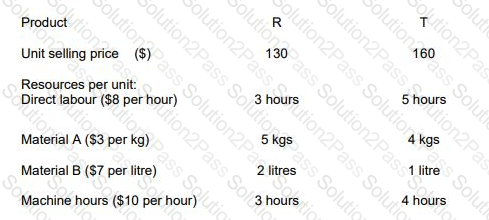

RT produces two products from different quantities of the same resources using a just-in-time (JIT) production system. The selling price and resource requirements of each of the products are shown below:

Market research shows that the maximum demand for products R and T during June 2010 is 500 units and 800 units respectively. This does not include an order that RT has agreed with a commercial customer for the supply of 250 units of R and 350 units of T at selling prices of $100 and $135 per unit respectively. Although the customer will accept part of the order, failure by RT to deliver the order in full by the end of June will cause RT to incur a $10,000 financial penalty. At a recent meeting of the purchasing and production managers to discuss the production plans of RT for June, the following resource restrictions for June were identified: Direct labour hours 7,500 hours

Material A 8,500 kgs

Material B 3,000 litres

Machine hours 7,500 hours

(Refer to previous 2 questions.)

You have now presented your optimum production plan to the purchasing and production managers of RT. During your presentation it became clear that the predicted resource restrictions were rather optimistic. In fact, the managers agreed that the availability of all of the resources could be as much as 10% lower than their original predictions.

Assuming that RT completes the order with the commercial customer, and using linear programming, show the optimum production plan for RT for June 2010 on the basis that the availability of all resources is 10% lower than originally predicted.

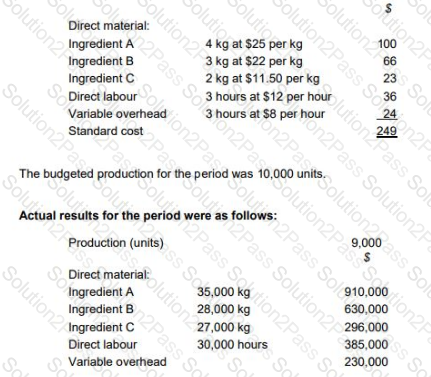

TP makes wedding cakes that are sold to specialist retail outlets which decorate the cakes according to the customers’ specific requirements. The standard cost per unit of its most popular cake is as follows:

The general market prices at the time of purchase for Ingredient A and Ingredient B were $23 per kg and $20 per kg respectively.

TP operates a JIT purchasing system for ingredients and a JIT production system; therefore, there was no inventory during the period.

Prepare a statement which reconciles the flexed budget material cost and the actual material cost. Your statement should include the material price planning variances, and the operational variances including material price, material mix and material yield.

What was the material price planning variance for ingredient A?

Explain how probability analysis could be used to assess the risk of the evaluated projects.

Select all the true statements.

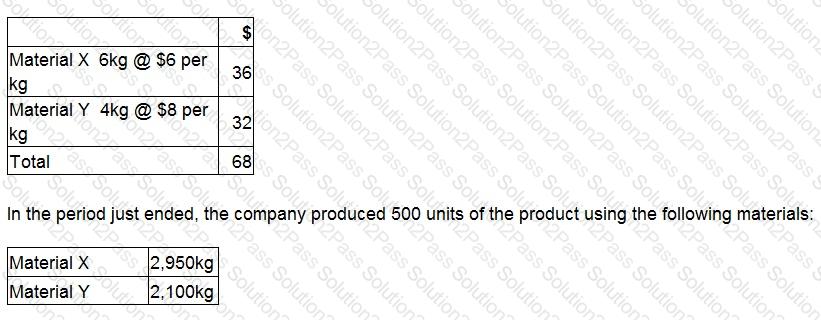

A company makes a product using two materials, X and Y.

The standard materials required for one unit of the product are:

What is the direct material mix variance for Material X, using the individual valuation basis?

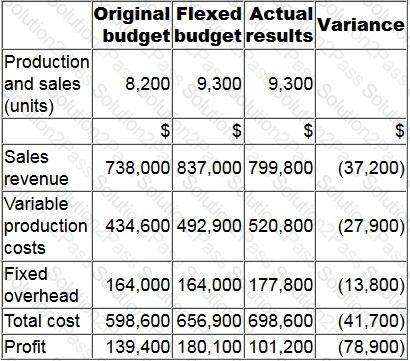

The budgetary control report of XYZ for the latest period is shown below. Variances in brackets are adverse.

What is the sales volume profit variance?

The standard output from a joint process is 4,000 litres of Product K, 6,000 litres of Product L and 3,000 litres of Product M.

The total cost of the joint process is $147,000.

The company is now deciding if it should further process Product L.

In the further processing decision the best way to apportion the joint costs to the products is:

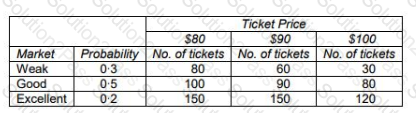

RS is a travel company providing daily tours of a major European capital city. The market is highly competitive and RS has commissioned some market research to help with the pricing decision for a new tour. The research identified the probability of three possible market conditions and the number of tickets that would be sold each day at three different price levels.

Demonstrate, using a decision tree and based on expected value, which ticket price RS should choose.

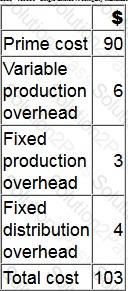

A company manufactures a single product. The cost card for a unit of this product is as follows:

During month 6, finished goods inventory increased by 350 units.

By how much would the profit differ in month 6 if finished goods inventory was valued at standard marginal cost rather than standard absorption cost?

A company is basing its budget on predicted sales of one of its products. They have tasked you with forecasting the sales in year 2. The company has found that a fairly accurate prediction can be found when the trend

is calculated like so:

a = 10,000

b = 2,000

The sales of year 1 were affected by seasonal variation and were as follows:

Q1:12,500

Q2:14,200

Q3:15,400

Q4:19,650

You use a multiplicative model and round percentages to the nearest whole percent.

Select ALL the correct quarterly forecasts of year 2 from the list.

Which THREE of the following statements about different costing systems are correct?

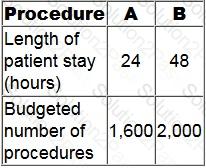

A clinic offers two types of procedure, A and B.

The clinic uses activity-based costing. The general facility overhead cost for next year is budgeted to be $8,601,600. The cost driver is the length of patient stay.

Additional data:

What is the general facility overhead cost for each Procedure B?

A time series (TS) is made up of two main components i.e. trend (T) and the seasonal variation (SV).

Which TWO of the following could be used to find the seasonal component of a trend?

Traditional absorption costing is more suitable than activity-based costing when:

A company produces and sells two products, product A and product B.

What are the total fixed costs when the weighted average contribution per unit is $5 and the breakeven points for product A and product B are 10,000 units and 5,000 units respectively?

Give your answer as a whole number (in 000's).

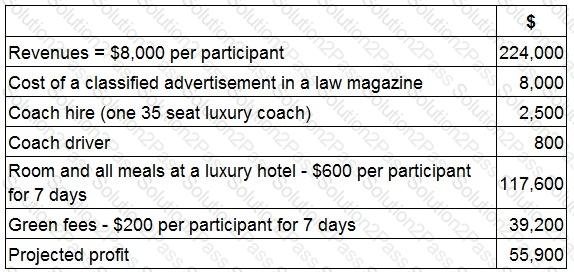

JKI is planning a golfing holiday for a group of wealthy lawyers.

The lawyers will fly to the local airport at their own expense. JKI will then pay for transport, accommodation and the use of the golf course (green fees).

JKI's costings are as follows, based on 28 participants:

JKI received 46 applications from potential participants.

What would the profit be if JKI accepted all of these bookings?

Give your answer to the nearest whole number.