P1 CIMA Management Accounting Free Practice Exam Questions (2025 Updated)

Prepare effectively for your CIMA P1 Management Accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2025, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Which THREE of the following would be contained within a master budget?

The simplex method has been used to determine the optimum output of products P, Q, R and S with constraints on resources J, K and L.

In the final simplex tableau, the figure in the product R row and the column for slack variable K is 80.

Which of the following statements is correct?

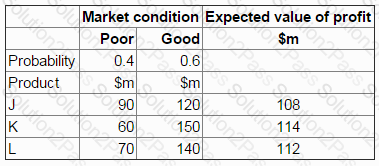

The marketing director of a company is deciding which of three products to launch into a new market.

The following table of possible outcomes has been prepared.

What is the value of perfect information about market conditions?

Give your answer as a whole number to the nearest $ million.

In a manufacturing company, breakeven occurs at which TWO of the following?

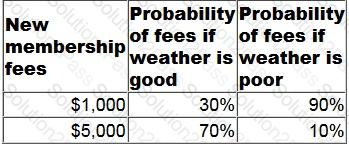

A tennis club is considering running an open day to encourage new members and thus increase membership fees. The cost of the open day will be $1,000. Attendance is dependent on the weather. There is a 60% chance of good weather and a 40% chance of poor weather on the open day.

The expected new membership fees are:

What is the expected value of running the open day?

Give your answer as a whole number.

A medium-sized manufacturing company, which operates in the electronics industry, has employed a firm of consultants to carry out a review of the company’s planning and control systems. The company presently uses a traditional incremental budgeting system and the inventory management system is based on economic order quantities (EOQ) and reorder levels. The company’s normal production patterns have changed significantly over the previous few years as a result of increasing demand for customized products. This has resulted in shorter production runs and difficulties with production and resource planning. The consultants have recommended the implementation of activity based budgeting and a manufacturing resource planning system to improve planning and resource management.

What are the benefits for the company that could occur following the introduction of an activity based budgeting system?

Select ALL the correct answers.

A pharmaceutical company manufactures pesticides which contain highly toxic chemicals.

In the context of environmental costing, which of the following would be classified as an external failure cost?

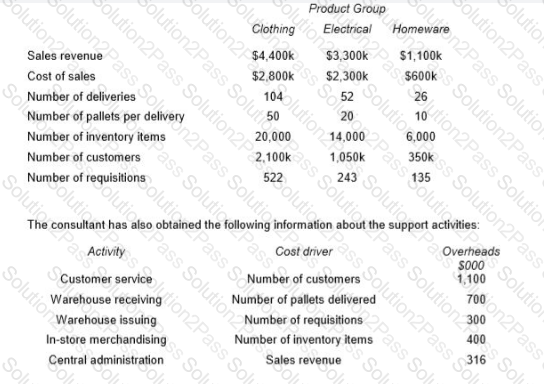

A major company sells a range of electrical, clothing and homeware products through a chain of department stores. The main administration functions are provided from the company’s head office. Each department store has its own warehouse which receives goods that are delivered from a central distribution center.

The company currently measures profitability by product group for each store using an absorption costing system. All overhead costs are charged to product groups based on sales revenue. Overhead costs account for approximately one-third of total costs and the directors are concerned about the arbitrary nature of the current method used to charge these costs to product groups.

A consultant has been appointed to analyses the activities that are undertaken in the department stores and to establish an activity based costing system.

The consultant has identified the following data for the latest period for each of the product groups for the X Town store:

Calculate the total profit for each of the product groups:

…. using the current absorption costing system;

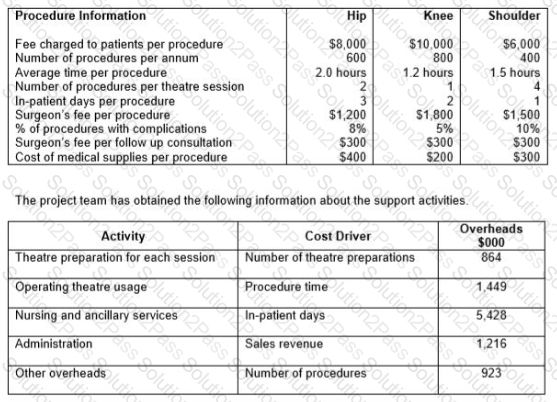

A healthcare company specializes in hip, knee and shoulder replacement operations, known as surgical procedures. As well as providing these surgical procedures the company offers pre operation and post operation in-patient care, in a fully equipped hospital, for those patients who will be undergoing the surgical procedures.

Surgeons are paid a fixed fee for each surgical procedure they perform and an additional amount for any follow-up consultations. Post procedure follow-up consultations are only undertaken if there are any complications in relation to the surgical procedure. There is no additional fee charged to patients for any follow up consultations. All other staff are paid annual salaries.

The company’s existing costing system uses a single overhead rate, based on revenue, to charge the costs of support activities to the procedures. Concern has been raised about the inaccuracy of procedure costs and the company’s accountant has initiated a project to implement an activity-based costing (ABC) system.

The project team has collected the following data on each of the procedures.

Calculate the profit per procedure for each of the three procedures, using the current basis for charging the costs of support activities to procedures.

What was the profit for the knee procedure?

Since there is no likelihood of them receiving a pay rise in the foreseeable future, your colleagues are considering leaving their current employment and starting their own business.

When preparing the data to evaluate their decision, their current salaries would be:

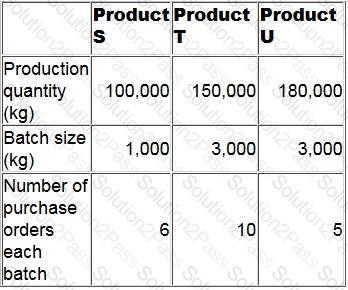

An agricultural company uses activity based costing to charge overheads to its three products. One of the main activities is purchasing, budgeted details of which are as follows:

Additional budgeted data:

What is the budgeted purchasing overhead cost per kg of Product S?

Give your answer to 2 decimal places.

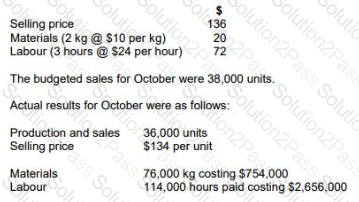

GH manufactures a product using skilled labour and high quality materials. The company operates a standard costing system and a just-in-time (JIT) purchasing and production system. The standard selling price and variable costs for one unit of the product are as follows:

Prepare a statement that reconciles the budgeted contribution with the actual contribution for October. Your statement should show the variances in as much detail as possible.

What was the actual contribution for October?

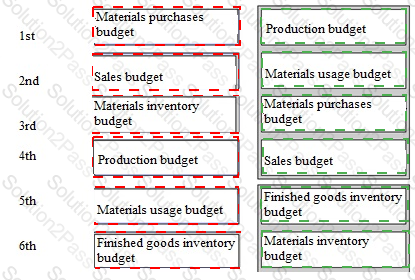

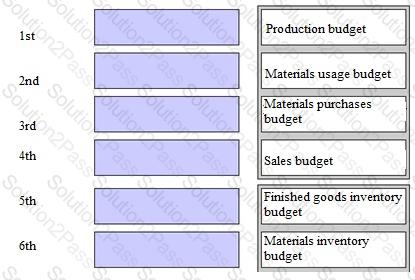

For a company that does not have any production resource limitations, what would be the correct sequence for budget preparation?

ABC uses an activity-based costing system.

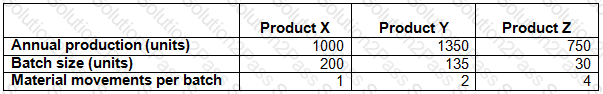

The company manufactures three products, details of which are given below:

Total material movement costs for the period are $10,000.

The material movement cost per unit for Product Z (to the nearest $0.01) is:

PL currently earns an annual contribution of $2,880,000 from the sale of 90,000 units of product B. Fixed costs are $800,000 per annum.

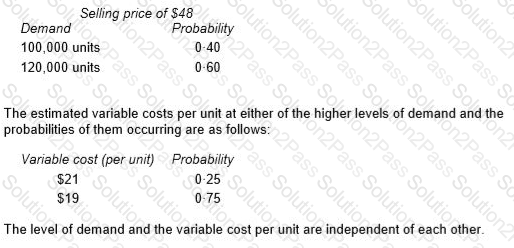

The management of PL is considering reducing the selling price per unit to $48. The estimated levels of demand at the revised selling price and the probabilities of them occurring are as follows:

Calculate the probability that the profit will increase from its current level if the selling price is reduced to $48.

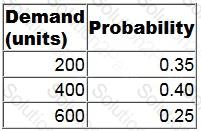

The daily demand for a perishable product has the following probability distribution:

Each unit of the product costs $6 and is sold for $10.

Unsold items are thrown away at the end of the day.

Orders must be placed each morning before the daily demand is known.

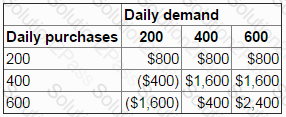

The payoff table below shows the profit that would be earned for each of the combinations of purchases and demand.

The number of units that should be purchased at the beginning of each day in order to maximize expected profit is:

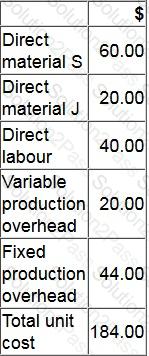

The cost card for one unit of Product G is as follows:

The opening and closing inventories of Product G for month 5 are budgeted to be 10 units and 60 units respectively.

Profit for month 5 using absorption costing is budgeted to be $15,000.

What is the budgeted profit for month 5 using throughput costing?

Which of the following managers is most likely to be responsible for an favourable labour efficiency variance?