P2 CIMA Advanced Management Accounting Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CIMA P2 Advanced Management Accounting certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

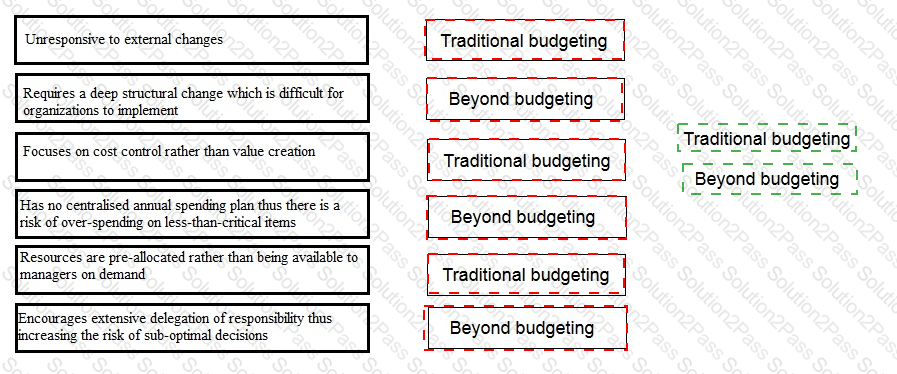

Which of the following criticisms relate to traditional budgeting methods and which relate to the 'beyond budgeting' approach?

Firefighters risk serious and potentially fatal accidents whenever they attend an incident.

Which of the following statements is correct?

Which TWO of the following actions taken during the budgetary planning process will result in the creation of budgetary slack?

An organization employs a dual pricing basis for the transfer of components between its divisions. This means that:

The discount rate at which the net present value (NPV) is zero is known as the

Which of the following statements is NOT correct?

Transfer prices between responsibility centers should be set at a level that:

Three years ago the large number of faulty products being returned by its customers resulted in a company adopting total quality management (TQM). The company has increased expenditure on staff training and product inspections. This has resulted in a reduction in the number of faulty products returned.

Which of the following statements is correct?

Which of the following is the ideal basis to use for a transfer price when there is a perfect external market?

A machine requires an initial investment of $500,000. The net present value (NPV) of the investment in the machine is $36,500.

Which of the following statements is correct in relation to the sensitivity of the investment?

A positive net present value (NPV) has been calculated for a project to launch a new product. An additional calculation is required to identify the sensitivity of the NPV to changes in the forecast total sales volume.

The present value of which of the following would be used in the calculation?

In accordance with a just-in-time (JIT) philosophy, which of the following is regarded as a value added activity?

Which THREE of the following conditions are required for a sustained learning curve to apply?

An investment centre is appraising a potential project that is expected to yield a Return on Investment (ROI) of 12%.

Without the project the investment centre expects to earn an ROI of 14%. The cost of capital is 10%.

What would be the impact on the investment centre's performance measures if the project is accepted?

Which of the following is a correct description of the key features of net present value?

Residual income is an appropriate performance measure for which type of responsibility centre?

For a complex and repetitive task, which of the following correctly describes a steep learning curve?

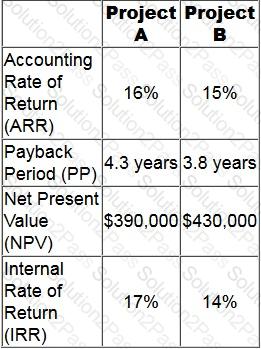

A company is considering two mutually exclusive projects, an analysis of which is given below:

The company's cost of capital is 12%.

Assuming an objective of maximising shareholders' wealth, which project would be recommmended?

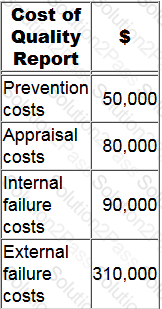

The following cost of quality report has been prepared for the latest period.

What is the difference between the cost of conformance and the cost of non-conformance?

Juan is looking to invest in the mining industry. He has narrowed his options down to two rival companies, both with sales of £200m. Company A has an EBIT of £10m whereas Company B has an EBIT of £14m.

This would suggest that Company B is the better investment but Juan is suspicious that Company B has more financial backing than Company A.

Which ratios will tell him which company will use his investment the best?

The money cost of capital is 12%. The expected rate of inflation is 4%. What is the real cost of capital?

Give your answer to 2 decimal places.