ICWIM CISI International Certificate in Wealth & Investment Management Free Practice Exam Questions (2026 Updated)

Prepare effectively for your CISI ICWIM International Certificate in Wealth & Investment Management certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

Which of the following underlies the pillars of risk tolerance?

Why might a custom benchmark be required when measuring portfolio performance?

Your client estimates that they will require £40,000 of income annually to live off when they retire. Personal plus state pension will provide £35,000. They wish to retire in 20 years' time. It is estimated that they can earn 3% per annum and inflation has been forecast at 2% over the next 20 years. Interest rates are currently 1.5%. Allowing for inflation, what lump sum would they need to accrue to supplement their pension?

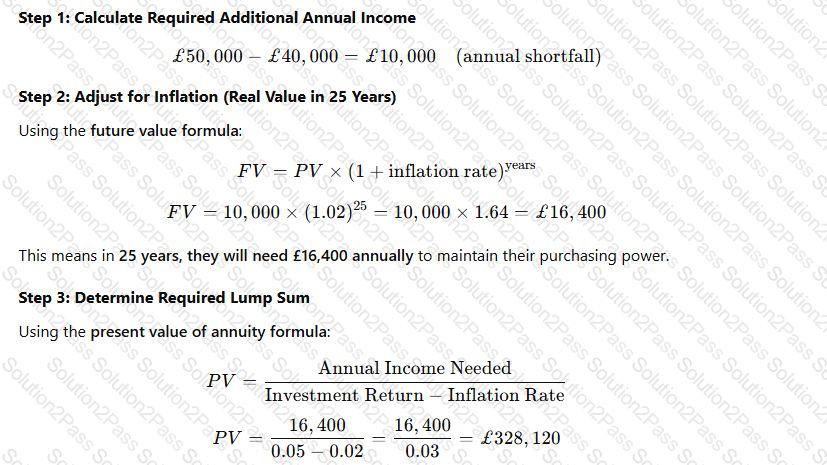

Your client estimates that they will require £50,000 of income annually to live off when they retire. Personal plus state pension will provide £40,000. They wish to retire in 25 years’ time. It is estimated that they can earn 5% per annum, and inflation has been forecast at 2%. Interest rates are currently 1.5%. Allowing for inflation, what lump sum would they need to accrue to supplement their pension?

Historically, rapid technological change and globalisation have:

Treasury bills are normally issued with a minimum maturity of:

A defined benefit pension scheme gives an employee the advantage of:

An execution-only sale usually means a sale where there is an absence of:

Back-end loading is often associated with:

A screenshot of a paper

AI-generated content may be incorrect.

A screenshot of a paper

AI-generated content may be incorrect.