8006 PRMIA Exam I: Finance Theory Financial Instruments Financial Markets - 2015 Edition Free Practice Exam Questions (2026 Updated)

Prepare effectively for your PRMIA 8006 Exam I: Finance Theory Financial Instruments Financial Markets - 2015 Edition certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

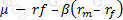

Which of the following expressions represents the Treynor ratio, where μ is the expected return, σ is the standard deviation of returns, rm is the return of the market portfolio and rf is the risk free rate:

A)

B)

C)

D)

Which of the following statements are true?

I. Macaulay duration of a coupon bearing bond is unaffected by changes in the curvature of the yield curve.

II. The numerical value for modified duration will be different for bonds with identical nominal coupons and maturity but different compounding frequencies.

III. When rates are expressed as continuously compounded, modified duration and Macaulay duration are the same.

IV. Convexity is higher for a bond with a lower coupon when compared to a similar bond with a higher coupon.

A portfolio comprising a long call and a short put option has the same payoff as:

Which of the following statements are true:

I. Forward prices for a stock will fall if dividend expectations increase for the period the contract is alive

II. Three month forward prices will decline if the 10 year rate goes up, and short term rates stay unchanged

III. Futures exchanges require buyers but not sellers to deposit initial margins

IV. Variation margin is to be deposited when a futures contract is entered into

V. Futures exchanges requires hedgers and speculators to deposit identical margins

VI. Interest rate futures contracts carry duration but no convexity due to the daily cash settlements

A futures contract is quoted at 105. Which is the cheapest-to-deliver bond for this contract if there are three available bonds, quoted at 97, 101 and 106 with conversion factors respectively of 0.9, 1 and 1.1 respectively?

What is the day count convention used for US government bonds?