8008 PRMIA PRM Certification - Exam III: Risk Management Frameworks, Operational Risk, Credit Risk, Counterparty Risk, Market Risk, ALM, FTP - 2015 Edition Free Practice Exam Questions (2026 Updated)

Prepare effectively for your PRMIA 8008 PRM Certification - Exam III: Risk Management Frameworks, Operational Risk, Credit Risk, Counterparty Risk, Market Risk, ALM, FTP - 2015 Edition certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

The unexpected loss for a credit portfolio at a given VaR estimate is defined as:

For an option position with a delta of 0.3, calculate VaR if the VaR of the underlying is $100.

Under the KMV Moody's approach to credit risk measurement, how is the distance to default converted to expected default frequencies?

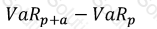

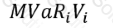

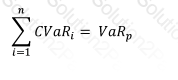

Which of the formulae below describes incremental VaR where a new position 'm' is added to the portfolio? (where p is the portfolio, and V_i is the value of the i-th asset in the portfolio. All other notation and symbols have their usual meaning.)

A)

B)

C)

D)

Which of the following methods cannot be used to calculate Liquidity at Risk?

What is the 1-day VaR at the 99% confidence interval for a cash flow of $10m due in 6 months time? The risk free interest rate is 5% per annum and its annual volatility is 15%. Assume a 250 day year.

When the volatility of the yield for a bond increases, which of the following statements is true:

According to the Basel framework, shareholders' equity and reserves are considered a part of:

Which of the following is the best description of the spread premium puzzle:

Which of the following statements are true ?

I. Risk governance structures distribute rights and responsibilities among stakeholders in the corporation

II. Cybernetics is the multidisciplinary study of cyber risk and control systems underlying information systems in an organization

III. Corporate governance is a subset of the larger subject of risk governance

IV. The Cadbury report was issued in the early 90s and was one of the early frameworks for corporate governance

Which of the following is not a possible early warning indicator in relation to the health of a counterparty?

Which of the following is not a measure of risk sensitivity of some kind?

Which of the following situations are not suitable for applying parametric VaR:

I. Where the portfolio's valuation is linearly dependent upon risk factors

II. Where the portfolio consists of non-linear products such as options and large moves are involved

III. Where the returns of risk factors are known to be not normally distributed

Which of the following is not an example of a risk concentration?

Which of the following are a CRO's responsibilities:

I. Statutory financial reporting

II. Reporting to the audit committee

III. Compliance with risk regulatory standards

IV. Operational risk

An investor enters into a 5-year total return swap with Bank A, with the investor paying a fixed rate of 6% annually on a notional value of $100m to the bank and receiving the returns of the S&P500 index with an identical notional value. The swap is reset monthly, ie the payments are exchanged monthly. On Jan 1 of the fourth year, after settling the last month's payments, the bank enters bankruptcy. What is the legal claim that the hedge fund has against the bank in the bankruptcy court?

A long position in a credit sensitive bond can be synthetically replicated using:

Which of the following are considered properties of a 'coherent' risk measure:

I. Monotonicity

II. Homogeneity

III. Translation Invariance

IV. Sub-additivity

If the annual default hazard rate for a borrower is 10%, what is the probability that there is no default at the end of 5 years?

What would be the consequences of a model of economic risk capital calculation that weighs all loans equally regardless of the credit rating of the counterparty?

I. Create an incentive to lend to the riskiest borrowers

II. Create an incentive to lend to the safest borrowers

III. Overstate economic capital requirements

IV. Understate economic capital requirements