PEGAPCDC87V1 Pegasystems Certified Pega Decisioning Consultant (PCDC) 87V1 Free Practice Exam Questions (2026 Updated)

Prepare effectively for your Pegasystems PEGAPCDC87V1 Certified Pega Decisioning Consultant (PCDC) 87V1 certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

MyCo, a telecommunications company, wants to implement one-to-one customer engagement using Pega Customer Decision Hub™. Which of the following real-time channels can the company use to present Next-Best-Actions? (Choose Three)

U+, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal. To show the offers per the bank’s requirements, the bank added all existing contact policy conditions. What is the immediate next step they should take?

U+ Bank, a retail bank, offers the Standard card, the Rewards card and the Rewards Plus card to its customers. The bank wants to display the banner for the offer that each customer is most likely to click; therefore, their Arbitration uses Propensity from the AI models. If you are debugging the Next-Best-Action decision strategy, which strategy component will show you if the result of the Arbitration is correct?

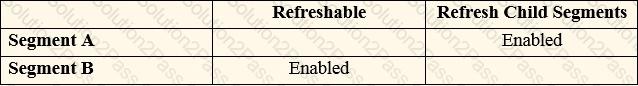

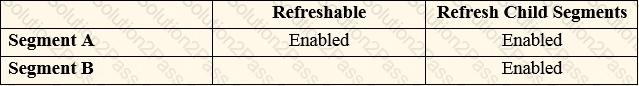

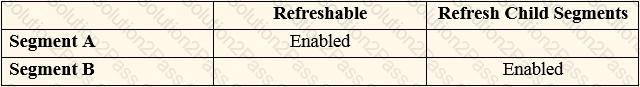

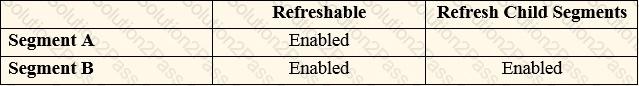

There are two segments: segments A and Segments B. The segments A references the segment B.

Which configurations is necessary to make sure that segment B is automatically refreshes when segment A is refreshed?

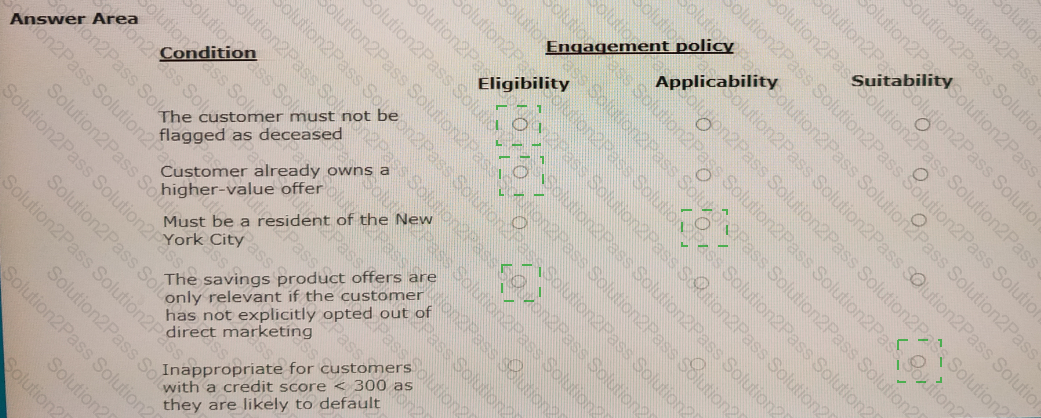

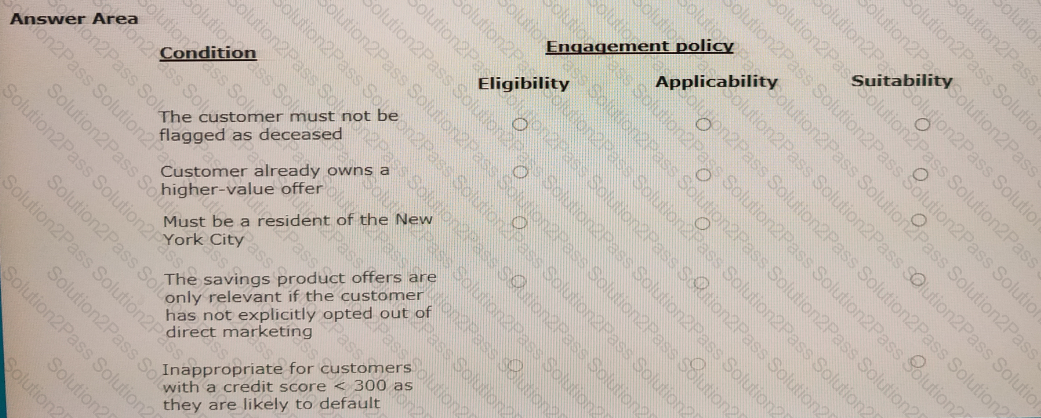

In the Answer Area, select the correct engagement policy for each condition.

Reference module: Analyzing customer distribution using Pega Value Finder.

As a Decisioning Consultant, you have just implemented a project to present mortgage offers to customers on their self-service portals. The bank asks you to pull data on the distribution of the offers to well-engaged, under-engaged, or not-engaged customers. Which simulation do you run to get the required information?

What does a solid arrow from a “Set Property” component to a “Filter” component mean?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer to the qualified customers on its website. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning consultant, you are now expected to make the remaining configurations in the Next-Best-Action Designer's Channel tab to enable the website to communicate with the Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you perform in the Next-Best-Action Designer's Channel tab? (Choose Two)

U+, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal. They have unit-tests in place using persona tests. The bank has recently added new engagement policy conditions to present credit cards to qualified customers and re executed the tests. They see failures in the tests. What do they do next?

Reference module: Essentials of always-on outbound.

A U+ bank customer tries to initiate a fund transfer. Due to a slow internet connection, the transfer ends abruptly. The bank then sends an email with a link to continue the incomplete transaction. Which type of outbound interaction is this?

Which statement is true about email treatments?

A bank is currently doing cross-sell on the web by showing various credit cards to its customers. Due to the credit limits of each card, the bank wants to present credit cards only to suitable customers who have a credit score greater than 500. Which component helps you to calculate a customer’s credit score?

Through analysis of customer lifecycles, Next-Best-Action ________

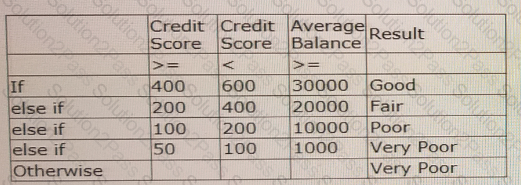

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

An outbound run identifies 100 Standard Card offers, 50 on email and 50 on the SMS channel. If the above volume constraint is applied, how many actions will be delivered by the outbound run?

Aggregation components provide the ability to________________.

MyCo, a telco, wants to offer a Fiber Optic Cable package only to customers who live in towns that have fiber optic cable available. Which engagement policy condition best suits this requirement?

Which two of these statements is true about Value Finder? (Choose Two)

A financial institution has created a new policy that states the company will not send more than 500 emails per day. Which option allows you to implement the requirement?

If the Pega Customer Decision Hub presents Next-Best-Action recommendations to a customer in a call-center, the Next-Best-Action is re-evaluated when _____, ____, and ____ (Choose Three)