PEGACPDC25V1 Pegasystems Certified Pega Decisioning Consultant 25 Free Practice Exam Questions (2026 Updated)

Prepare effectively for your Pegasystems PEGACPDC25V1 Certified Pega Decisioning Consultant 25 certification with our extensive collection of free, high-quality practice questions. Each question is designed to mirror the actual exam format and objectives, complete with comprehensive answers and detailed explanations. Our materials are regularly updated for 2026, ensuring you have the most current resources to build confidence and succeed on your first attempt.

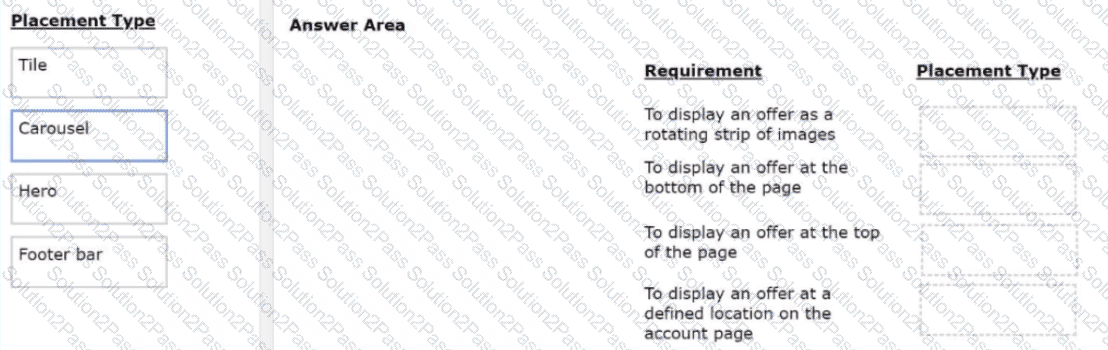

U+ Bank has decided to use the Pega Customer Decision Hub, M to recommend more relevant banner ads to its customers when they visit the personal portal. Select each placement type on the left and drag it to the correct requirement on the right.

GlobalRetail operates in a fast-changing digital marketplace where customer preferences and competitor offers change weekly. Their marketing team struggles with lengthy approval processes that prevent quick responses to market trends, often causing them to miss critical engagement opportunities.

What does agility represent in the context of customer engagement projects?

U+- Bank uses Next-Best-Action Designer to configure engagement policies for different customer segments. A business user wants to create reusable policy conditions that can apply across multiple actions and campaigns. The user must understand when the save-to-library feature is available.

When is the save-to-library option unavailable for engagement policy conditions?

An NBA Specialist Is configuring the engagement policy for a new loan offer and wants to validate the policy. What is the best way for the NBA Specialist to validate the engagement policy?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

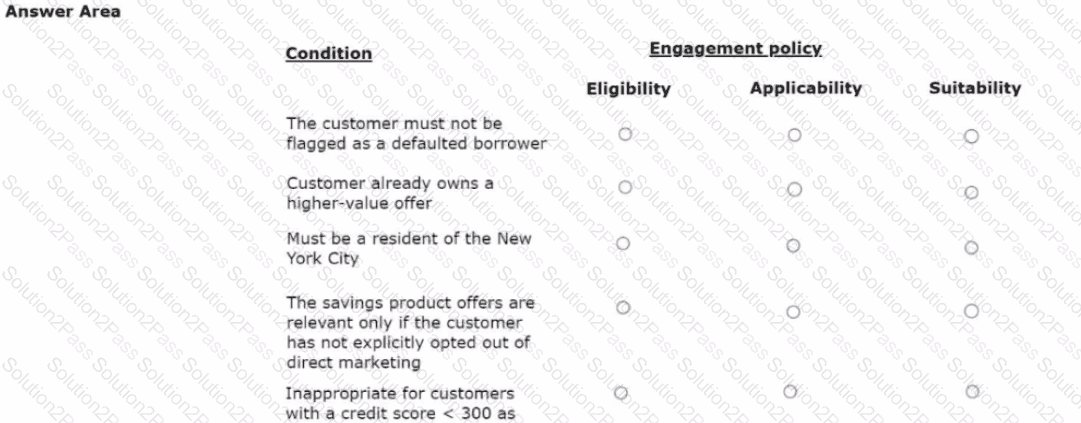

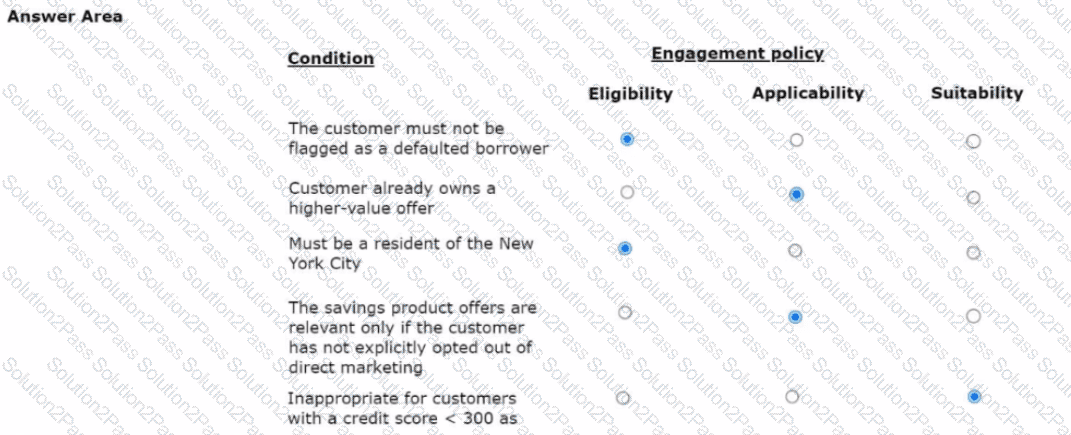

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal. The bank added engagement policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

U+ Bank, a retail bank, has purchased Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

U+ Bank is promoting a new premium credit card with an 18% APR to its existing customers. To protect customer value, the bank wants to avoid offering this card to customers who already hold a credit card with a lower Interest rate (12% APR or below).

Which engagement policy condition type should you use to exclude customers with lower-interest cards from receiving the premium offer?

In the following figure, a volume constraint uses the Return any action that does not exceed constraint mode with the three following action type constraints that have remaining limits:

1.Maximum 50 Daily with Action: Protect Your Device, 5 remaining

2.Maximum 75 Daily with Action: MyFone Buds, 7 remaining

3.Maximum 25 Daily with Action: MyFone AirPods Pro, 0 remaining

A customer, CUST-01, qualifies for all the three actions. Given this scenario, how many actions does the system select for CUST-01 in the outbound run?

A financial institution has created a new policy that states the company will not send more than 500 emails per day. Which option allows you to implement the requirement?

U+ Bank implemented a customer journey for its customers. The journey consists of five stages. The bank observes that as customers progress through the journey, one customer entered the third stage of the journey, and then received an offer that is not included in any journey.

Which statement explains the cause of this behavior?

U+Bank presents various credit card offers to Its customers on Its website. The bank uses AI to prioritize the offers according to customer behavior. After the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

U+ Bank uses the always-on outbound approach to send outbound messages on different channels such as email. SMS, and push notifications. There are a variety of action flow patterns in use to meet various business and channel integrations requirements.

Due to technical reasons, the bank wants to temporarily suspend sending outbound messages and Instead write the selected customers and action details to a database table for later offline processing.

What is the most efficient way to meet this requirement?

The development team at U+Bank wants to create multiple test personas for their new engagement strategy quickly. A team member suggests using Pega GenAI features instead of creating a manual persona to improve efficiency and speed up the testing process.

Which advantage does Pega GenAI provide when creating personas compared to manual creation?

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

A decisioning architect wants to use the customer properties income and age in a Filter component. Which decision component is required to enable access to these properties?

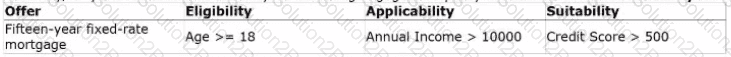

U+- Bank, a retail bank, has recently Implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

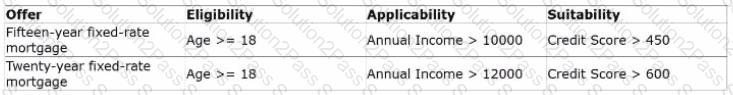

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer, Twenty-year fixed-rate mortgage.

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the business operations environment?

U+ Bank, a retail bank, has recently implemented Pega Customer Decision Hub. The bank currently uses an external tool to design email content and a third-party email service provider to send emails to its customers.

As a decisioning architect, how do you recommend the bank implements this requirement?

U+ Bank, a retail bank, uses the Business Operations Environment to perform business changes. The team members of the Business Content team and Enterprise Capabilities team perform several roles in the change management process.

Select each role on the left and drag it to the task descriptions to which the role corresponds on the right.

What does a dotted line from a "Group By" component to a "Filter" component mean?

A screenshot of a survey

AI-generated content may be incorrect.

A screenshot of a survey

AI-generated content may be incorrect. A close-up of a task

AI-generated content may be incorrect.

A close-up of a task

AI-generated content may be incorrect.